September 12, 2020 | Trading Desk Notes September 12, 2020

The big drivers of market psychology year-to-date have been, 1) the virus (and its anticipated knock on effects) followed by, 2) massive stimulus from Central Banks and governments. The virus psychology drove equities and commodities down hard…while driving bonds and the USD higher…whereas the stimulus has had the reverse effect on equities, commodities and the USD. Bonds have essentially flat lined since April. We think the “risk on” market psychology that has driven equities and commodities higher and the USD lower is in the process of reversing and we’ve been trading accordingly.

The stimulus induced “risk on” market moves since March have created many versions of the,“It’s All One Market” idea about cross-asset correlations. In simpler terms a veteran trader told us, “You gotta get the equity market right…no matter what you’re trading!”

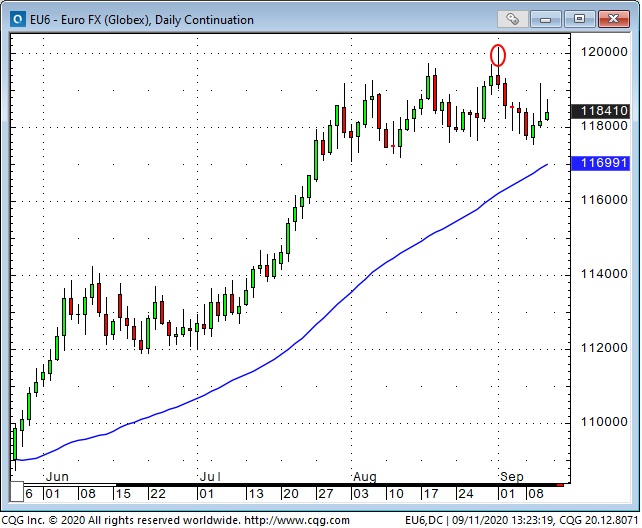

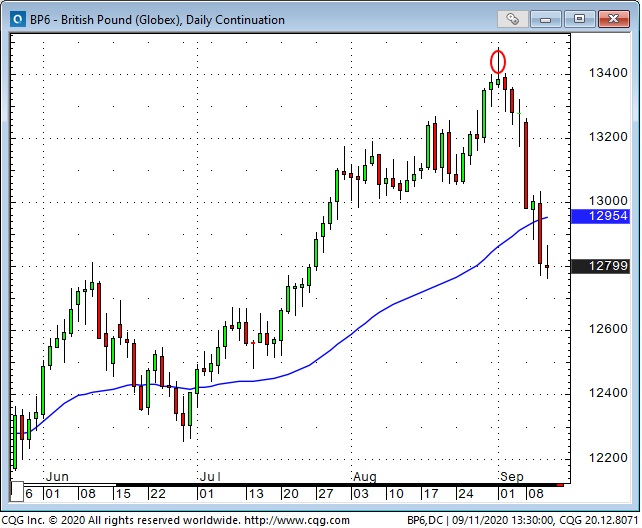

We wonder if we’re seeing another Key Turn Date (KTD) in the first few days of September. A KTD occurs when a number of different markets all change direction on/around the same date…thereby making the turn all the more significant. To illustrate, we’ve added 50 day moving averages and circled possible KTDs on all of our charts this week.

The equity markets and especially the mega-cap tech stocks have had a spectacular run...capped by truly unprecedented public speculation the past few weeks…whereby “folks” were buying short-dated out-of-the-money calls to max leverage their bullish views. Option trading pros call these “Lottery Tickets”…given that the max possible loss is 100% of the premium paid while the max possible win is unlimited.

We see this option activity as just another expression of Bob Farrell’s rule that the public buys the most at the top…but remind our readers that “topping action” is a process…a 180 degree turn is unlikely…more likely would be a failed attempt at a new high…followed by a break of the early Sept lows.

The US Dollar Index briefly hit a 17 year flight-to-quality high in March and has fallen ~10% since then in two stages. Stage One was backing off the March highs (but still maintaining multi-year highs) while Stage Two (which was a much bigger move) began in mid-May when Macron/Merkel launched their “Euro-wide” reconstruction bond idea. (I’ve written previously about the market seeing this as a possible first step towards a fiscal union.) The speculative net bearish USD positioning in the futures markets is currently at a 9 year high.

The Stage Two leg of the USD decline was primarily powered by the rally in EURUSD...with other currencies following the EUR higher against the USD. The power of the EURUSD rally can be seen in the dramatic change in futures market net speculative positioning. In March speculators were the most net short EURUSD they had been in 4 years…by July they were All Time record most bullish…and that bullishness continued to grow throughout August. This swing from very bearish to very bullish in just over 4 months is the biggest swing ever (in futures market COT data) for EURUSD. We think EUR looks toppy and a break of the August lows could set off a significant tumble.

Gold rallied to a new All Time High above $2000 in early August but has chopped back and forth in ~$100 range since then. We think the stimulus inspired gold rally was largely expressed in the gold ETF market which had global record high assets of ~$240B at the end of August…up ~$100B since the beginning of the year. The buying of gold ETFs in the first 8 months of 2020 has been greater than any previous full year’s buying with the American ETFs dominating the global total. We understand the “pro-gold” arguments…and could easily see gold higher in the next couple of years…BUT…we think there has been some “fast money” come into the gold market and if prices break the August lows, the trend line and the 50 DMA we could see some significant selling.

The British Pound traded within a couple of ticks of a 2 year high on Sept 1st but has tumbled the past two weeks as Brexit concerns undercut “cable.”

The Canadian Dollar has surprised us with its strength the past couple of months. It’s been highly correlated with the weak USD, rising stocks and commodities, but may have made an important turn lower on Sept 1st.

In previous Trading Desk Notes we’ve described crude oil as a lack-of-demand story. WTI futures prices finally started to tumble around the Sept KTD. We’ve expressed our bearish views by buying WTI time spreads the past couple of months looking for the nearby months to weaken relative to the deferred months. (The 2nd chart shows December falling from around a 25 cent discount to March during July to around $1.37 discount now.) We’ve also thought that IF the energy markets are a better economic barometer than the equity markets THEN be careful buying stocks…even though the past few months there seems to have been very little correlation between the economy and the stock market!

If you’d like to know more about using the futures and options market to trade currencies, metals, interest rates, stock indices, energy and other commodities please contact Drew Zimmerman at PI Financial Corp in Vancouver.

PI Financial Corp. is a Member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or the authorize someone else to trade for you, you should be aware of the following. If you purchase a commodity option you may sustain a total loss of the premium and of all transaction costs. If you purchase or sell a commodity futures contract or sell a commodity option or engage in off-exchange foreign currency trading you may sustain a total loss of the initial margin funds or security deposit and any additional fund that you deposit with your broker to establish or maintain your position. You may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. If you do not provide the requested funds within the prescribe time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account. Under certain market conditions, you may find it difficult to impossible to liquidate a position. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities and/or futures and options. Any distribution or dissemination of this in any other jurisdiction is strictly prohibited. Past performance is not necessarily indicative of future results

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 12th, 2020

Posted In: Victor Adair Blog

Next: This Week in Money »