September 8, 2020 | The Truth About Obscenely Priced ‘Investments’

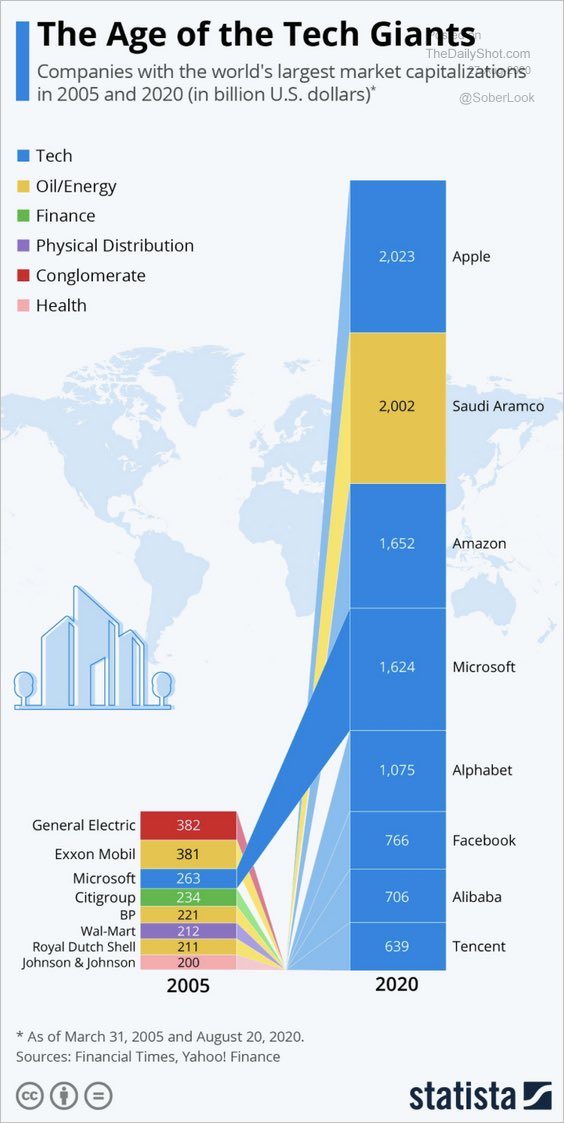

While the largest tech companies have leapt in price, aggregate earnings for NASDAQ 100 companies have fallen 30% year to date. Before last week’s modest sell-off, the largest five–Apple, Microsoft, Amazon, Facebook and Google (Alphabet)–accounted for a record 23% of the entire S&P 500 index, the highest concentration of the top five on record, even surpassing the 2000 tech top. The chart on the left shows the market capitalization (price x shares) of the eight largest global companies in August 2020 (bar on right ) versus 2005 (on left). Seven of the eight are tech names (in blue) compared with one in 2005.

Falling 78% after the March 2000 top, it took 15 years for the NASDAQ index to recover in price, and many of the original companies went bankrupt and left the index long before then. Most of those who held the shares at peak valuations in 2000 had liquidated in losses before the next tech bubble began in 2015. Those holding today, are likely to see a similar loss cycle in the months and years ahead.

Price indiscriminate buying is the rage today, and those who are doing it with wild abandon appear to be the smartest folks in the room. This is a hallmark of financial bubbles and this too shall pass.

The clip below makes many prescient observations about the mania in Tesla shares, but they are also applicable to the manic pricing in many other market darlings in 2020.

“Whatever best-case scenario you want to paint for what Tesla’s going to do – whether they’re going to produce 30 million cars within the next 10 years, and get in the insurance business and have the same high margins as Toyota, the most efficient car company with scale of all-time – even if you do believe all that is true, the stock price is still implying that profits are going to be even bigger than that,” Trainer told CNBC’s “Trading Nation” on Thursday…A more realistic valuation, says Trainer, would be far lower than current levels.

“I think around a 10th of what it is is probably appropriate if you look at, you know, kind of a reasonable level of profits,” he said. Here is a direct video link.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park September 8th, 2020

Posted In: Juggling Dynamite