September 1, 2020 | The Fed’s ‘Sink Holes’

First it was Minneapolis. Then Atlanta, Portland, Ore. and almost every other major American city.

Then, last week, even sleepy Kenosha, Wis. boiled over.

The unrest spreading across America has multiple drivers. And one is an economic “sink hole” — like the ones I mentioned last week — courtesy of your beloved U.S. Federal Reserve …

The Greatest Wealth Gap of All Time

Wondering where nearly all the Fed’s newly printed funny money has gone?

Simple: To the biggest risk-takers, who also happen to be the folks who can AFFORD to take the most risk.

What’s worse, those risk-takers have been perversely REWARDED for their wayward ways.

With the Fed backing them up for the last ten years, the more risks they took, the more money they made.

As a result, the rewards of America’s prosperity have been stuffed into the pockets of elite Wall Street fat cats and their corporate clients, while Main Street is going broke.

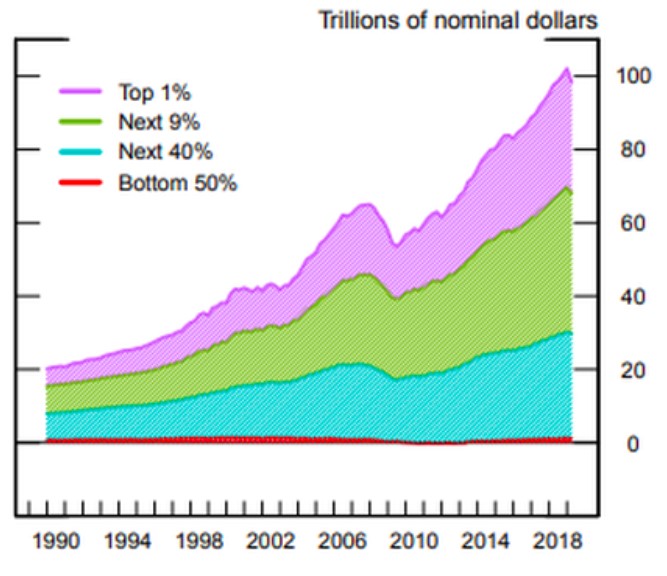

Our Weiss Ratings tells the story:

The lowest-rated, highest-risk companies got the bulk of the new money, while millions of retirees and savers consistently got the raw end of the deal. As a result, the top 10% of America’s households now hold 70% of the nation’s wealth.

In fact, the top 1% now hold almost 40% of that wealth.

And if you thought that was extreme, consider this:

|

A recent Oxfam study found that the eight richest people in the world (six of them Americans) own as much combined wealth as half of the entire human race.

So, sure, with the Fed printing new money by the trillions of dollars, a handful of people at the top are making out like bandits.

But most Americans are left holding the bag.

Case in point: The humble money market fund.

Returns are so low, they’re basically zero … only to be “rescued” by a cut in fees.

The goal is to make it look like your account isn’t losing money.

But fees can only be cut so far.

It isn’t supposed to be this way. You save money, and it’s supposed to pay off in your “golden” years.

But the Fed has upended the rules.

Even the World Bank is sounding the alarm, saying America is at a “tipping point”.

It’s a good idea to hold onto cash, but you also want to have your money working for you …

Because investing is the new saving.

And while stocks in general are a bit expensive right now …

Precious metals — still in the early stages of a years-long epic bull market — are coiling up for yet another breakout.

I’ve been recommending you get some exposure to the BIG gold miners with the VanEck Vectors Gold Miners ETF (NYSE: GDX, Rated “B-”).

|

But your returns can be even BIGGER by investing in individual companies with the fundamentals of a 350-pound lineman …

… like the one I just told my Wealth Megatrends subscribers about.

All the best,

Sean

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Sean Brodrick September 1st, 2020

Posted In: Wealth Wave