In the current crisis, their traditional toolkit, which focuses on manipulating interest rates, has failed.

Is there more that the Bank of Canada can do during this economic emergency?

Here is an excerpt of an interview with a central banker:

“So, it is fair to ask what we would do in the unlikely event that the economy was hit with another major negative shock, one that significantly threw off our projection. With the economy already exhibiting slow growth and interest rates already very low, there would appear to be very little room to manoeuvre. Indeed, the Bank’s policy rate today is 0.5 per cent, just one-quarter point above the record low set in 2009, a dark time for the global economy.”

Sound familiar?

That was Stephen Poloz, then head of the Bank of Canada, speaking to MacLean’s in 2015. Poloz goes on to suggest that the BOC has more extreme measures that could be enacted in the event of a “major negative shock”.

The four extreme measures mentioned were forward guidance, large-scale asset purchases, funding for credit and negative interest rates. We can ignore forward guidance and funding for credit, as these have been tried and found wanting.

The two remaining unconventional measures, large-scale asset purchases and negative interest rates are on the top of the list to be used during this emergency.

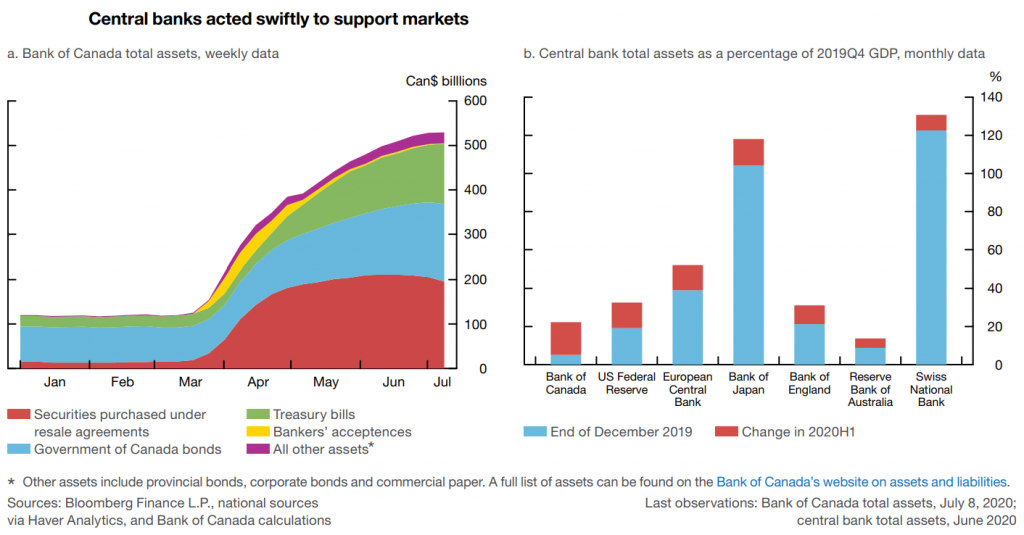

Large-scale asset purchases, also referred to as quantitative easing (QE), involves buying financial assets such as government bonds, mortgages, and corporate bonds from the private sector. The most important impact of this activity is to lower the interest rate on the securities that are purchased. Central bankers have been using this tool since 2009 with limited success. The BOC’s QE in 2020:

Low interest rates by themselves are not enough.

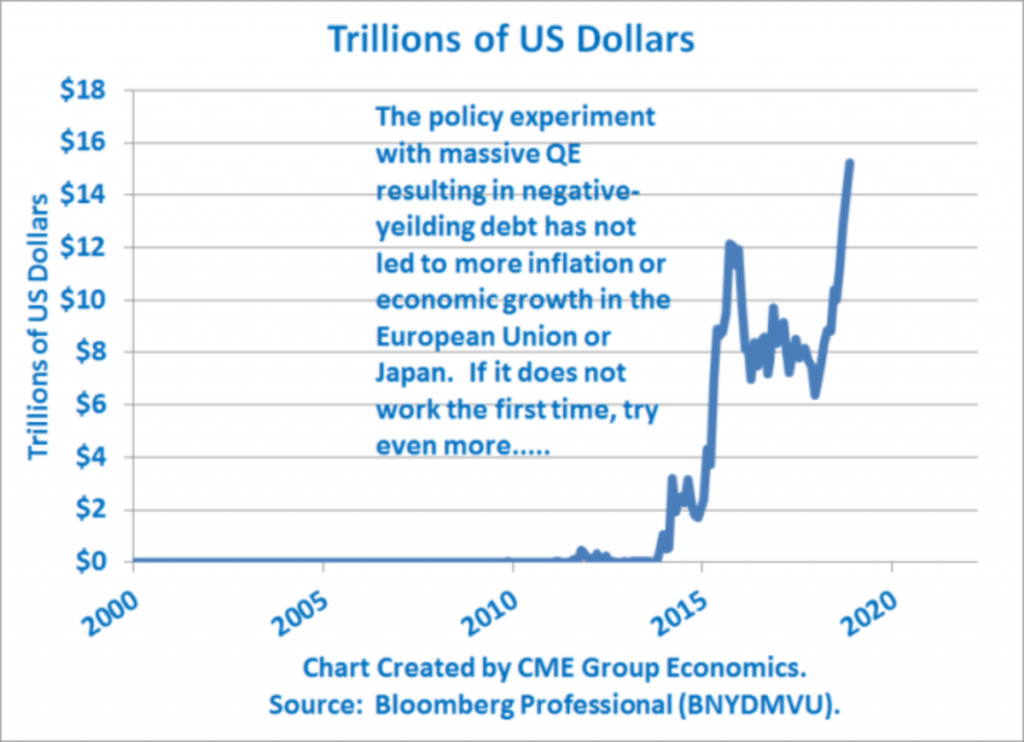

So that leaves negative interest rates as the remaining tool. The Bank of Canada has consistently rejected this approach in the past. European and Japanese central banks have tried negative interest rates for years and this measure has not worked as intended. Also, negative interest rates have the unfortunate side effect of hurting bank profits, which impairs their ability to boost lending.

From an article in September 2019 called “The Federal Reserve is out of options”.

Economist John Maynard Keynes concluded that, in a severe economic downturn like the Great Depression of the 1930s, monetary policy did not work. In some circumstances the liquidity preference for cash among households and businesses is so strong, due to fear and uncertainty, that there is no interest rate or QE policy that can force consumers to spend more and businesses to invest.

The July 2020 BOC Monetary Policy report hows that consumers have reduced spending:

This is happening when households have lost about $21 billion in employment income, but government transfers have increased by $54 billion. Many consumers have taken deferrals from payments for mortgages, auto loans and credit cards although these deferrals expire starting in the next three weeks.

The MPR concludes with “Alternative Scenarios and Risks”. On the downside a second wave of COVID-19 could lead to “widespread household, corporate and sovereign defaults given elevated debt levels” and “a much weaker scenario [that] could crystallize the risks associated with high household indebtedness.”

On the upside the BOC says that, when confidence returns, large household savings could become pent-up demand.

As the deferral cliff approaches, I would be more concerned about downside risks, given the lack of effective policy tools available to central bankers.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.