August 8, 2020 | Trading Desk Notes August 8 ,2020

On June 20, 2020 we wrote, “Markets currently seem to be highly correlated into a simple “risk on / risk off” dichotomy…with the emini S+P futures leading the way while other markets follow.” Some people refer to it as, “All One Market,” and from a macro perspective it’s been a “risk on” market since mid-June as:

- Bond yields have trended lower,

- Real yields have trended lower,

- Stocks indices have trended higher, with big cap tech up the most,

- USD has trended lower, especially against Euro area currencies, AUD and NZD,

- Gold and silver have trended (?) higher,

- Commodity indices have trended higher.

Regular readers know that we’ve been skeptical about the endurance of this “risk on” run…we’ve taken a few small counter trend positions and have lost a little money. We remain skeptical…and think we may be seeing signs of a turn in sentiment in some markets…which may spread to other markets. Regular readers will also remember our referencing “Key Turn Dates” from time to time. These are points in time when a number of markets all reverse course at/around the same time…and because so many market change direction at the same time it “means” that the “turn” in individual markets is all the more important. We wonder if we’re going to see another KTD here in mid-August.

Gold has closed higher for 9 consecutive weeks…rallying ~$400 from the June lows to this week’s highs. Investment demand the last 5 months has been dominated by very heavy buying of American gold ETFs which has more than offset reduced traditional retail buying in India and China. The gold rally has been highly correlated with falling real interest rates. The “sentiment” in the market seems to be that massive global stimulus will debase currencies and cause inflation: therefore buy gold and silver. We think the rally is overdone. There was a daily key reversal down Friday. We bought a long-dated bearish put spread at the end of last week and shorted gold futures this Friday.

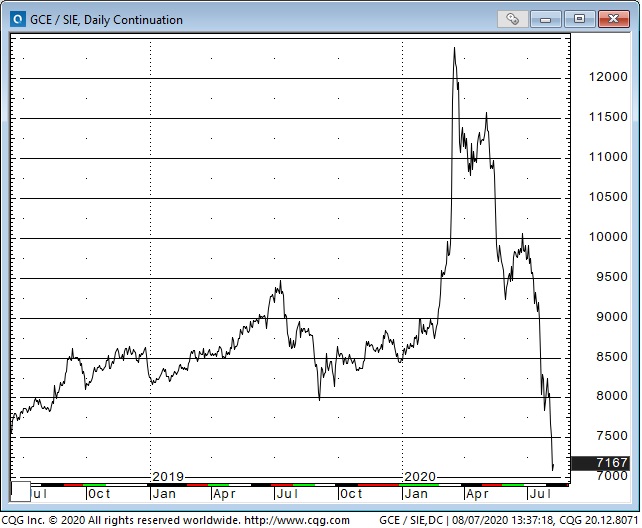

The gold/Silver ratio hit a 50 year high in March and has fallen sharply as silver has skyrocketed against the USD and against gold. We take this as a serious warning sign that PM bullish sentiment is at an extreme.

Falling real interest rates have been highly correlated with rising gold prices. The 10 year TIPS reversed this week after hitting record highs. (Rising TIPS = falling real rates.)

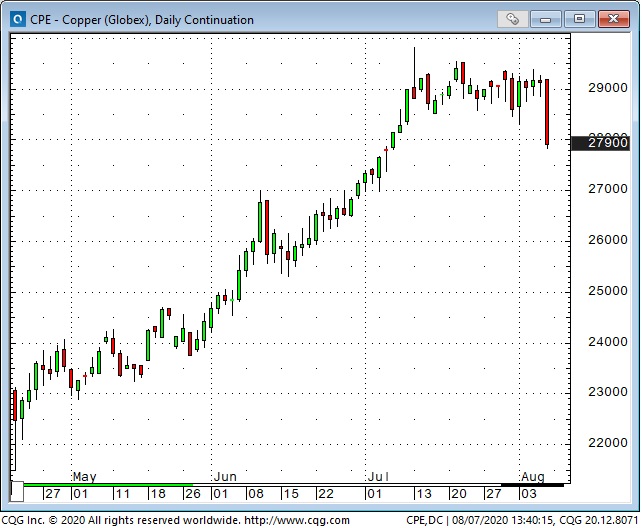

Copper rallied 50% from the March lows to the July highs. We wrote last week that copper was looking tired and wondered if Dr. Copper was signaling a lack-of-demand in the real world. Copper got more “tired” this week.

The US Dollar index has dropped ~10% from its March highs (when the whole world wanted USD for safety) to this week’s 26 month lows. We think this is the result of Euro area currencies rallying (EURUSD hit 3 year lows in March) especially from mid-May when Merkel/Macron announced their plan to “save Europe” with an EU wide guaranteed bond. Markets may have seen this as a “major step” towards a common EU financial union…which has always been the “missing link” in EUR credibility. (Skeptics may see the Merkel/Macron plan as a “hail Mary”…but EURUSD is up ~10%.) We think Euro strength is overdone…net speculative long positioning is near extreme…and we have taken a small short position. We also think the Canadian dollar struggles above 75 cents and are short CAD.

Supporting our idea that USD weakness has been the result of Euro strength is the fact that EUR has also rallied sharply against YEN and CHF since mid-May. (We’ve long believed that the easy “short EUR” trade for continental Europeans worried about Europe has been to sell EURCHF.)

Front month WTI hit it’s best levels in 5 months this week ~$43.50 but fell back into the narrow range it’s been in the past few weeks. We continue to see WTI as a lack-of-demand story and have added to our short nearly/long deferred contango spreads.

Our trading time horizon is from a few days to a few weeks. We believe net trading profits come from good risk management…not a crystal ball…we almost always use stops and if trades are not working we exit quickly…unless we have decided beforehand to give a specific trade a “little more time.” For instance, we own long dated put spreads in S+P and gold. Put spreads have a predefined maximum risk and the spread position reduces theta, delta and vol decay…allowing us to sit with a trade longer than we otherwise might.

If you’d like to know more about using the futures and options market to trade currencies, metals, interest rates, stock indices, energy and other commodities please contact Drew Zimmerman at PI Financial Corp in Vancouver.

PI Financial Corp. is a Member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or the authorize someone else to trade for you, you should be aware of the following. If you purchase a commodity option you may sustain a total loss of the premium and of all transaction costs. If you purchase or sell a commodity futures contract or sell a commodity option or engage in off-exchange foreign currency trading you may sustain a total loss of the initial margin funds or security deposit and any additional fund that you deposit with your broker to establish or maintain your position. You may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. If you do not provide the requested funds within the prescribe time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account. Under certain market conditions, you may find it difficult to impossible to liquidate a position. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities and/or futures and options. Any distribution or dissemination of this in any other jurisdiction is strictly prohibited. Past performance is not necessarily indicative of future results

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair August 8th, 2020

Posted In: Victor Adair Blog

Next: This Week in Money »