The Fed’s money-printing presses are running at ludicrous speeds. And what the government doesn’t print, it just borrows on credit and spends. The Federal debt is approaching $27 trillion at ballistic speeds. By 2028, it is projected to rise to $78 trillion!

How does any civilization keep going like this for long?

As I mentioned in a previous article, one of the most important cycles is the “civilization cycle” of 1030 years.

An equally important cycle — lasting 516 years — is impacting us now.

The predicted 516-year cycle top was in 2007 and, sure enough, the stock market rolled over and we went into the “Great Recession.”

Many expected the market to drop a lot further than it did in 2008-2009.

But central banks think they can thumb their nose at natural laws. They think markets and economies should keep going up forever.

So, they inject trillions of dollars and lower interest rates to zero (and below).

But all the “banksters” have done is make the debt larger, people poorer and inflated the debt balloon to the breaking point …

… creating an economic disaster that will be far worse than it otherwise would have been.

When L. Frank Baum wrote “The Wonderful Wizard of Oz” in 1900, many saw a hidden message: his concern over the historic shift then taking place in the monetary regime.

In the 1890s, U.S. politicians were still debating who should create the nation’s money and what exactly it should consist of. Should it be created by the government and be accountable to the citizenry …

… or should it be created by private banks behind closed doors?

In its original charter in 1694, the Bank of England created the model for today’s private banking “money tree.”

|

| SOURCE: BlogSpot.com |

Here’s what Mayer Amschel Bauer Rothschild said (the Rothschild dynasty was at the core of this first central bank) …

“Let me issue and control a nation’s money and I care not who writes the laws.”

A circular in its stock offering stated, “The Bank hath benefit of interest on all money which it, the Bank, creates out of nothing.”

This was nothing more than interest charged to the government for “free” money. And England’s national debt soared from $1.2 million pounds to 16 million pounds in just four years due to the compounding interest.

With all this, people read between the lines of Baum’s timeless classic to find some interesting allegories:

|

The yellow brick road represented the classic gold standard, with “Oz” short for ounce … which is how gold (and silver) are priced.

Dorothy — “the small and meek” — symbolized the innocent and powerless American people … led astray and seeking the way home.

The silver shoes (not ruby slippers, as in the 1939 Hollywood movie) embodied the “Silverite” support for real money …

… that Dorothy never realized she already had a viable currency (silver) to lead her safely “home”.

The Emerald City symbolized the world of “greenback” paper money that only pretends to have value. It’s ruled by a scheming politician (the Wizard) who uses publicity stunts and tricks to fool the people — and even the good witches — into believing he’s benevolent, wise and all-powerful …

… when in reality he’s a selfish humbug.

Some say Glinda, the Good Witch of the North, represented President Abraham Lincoln, who pursued a fair monetary system by having the government issue money during the Civil War. But the bankers reclaimed control following his assassination.

|

| Source: The Daily Signal |

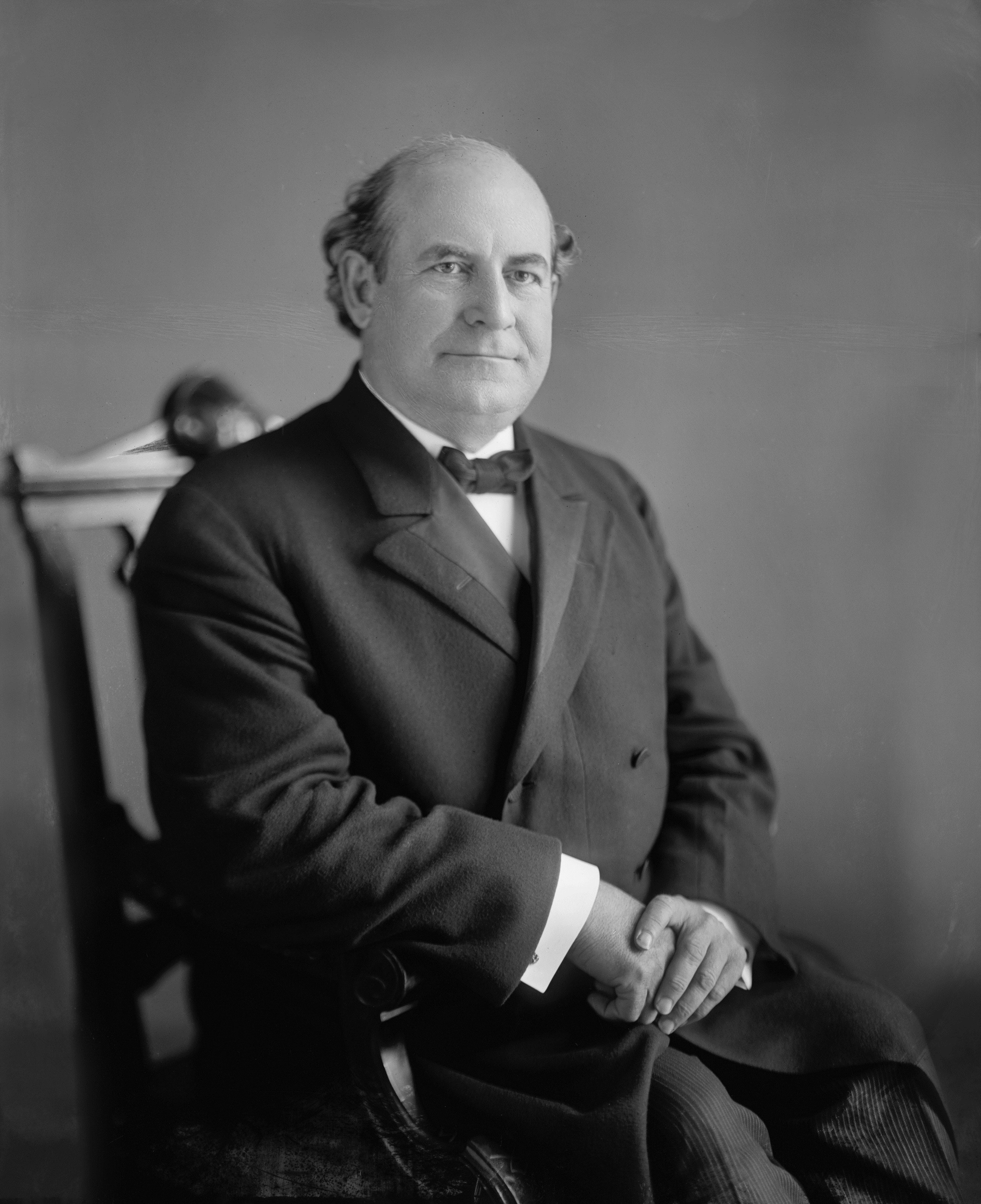

The Cowardly Lion is William Jennings Bryan, the candidate for president in 1896 and 1900 who opposed Wall Street and the Morgan/Rockefeller banking cartel (the Wicked Witch of the West?) …

… which was bent on taking away the power of creating money from the people and the government … and ultimately the world.

Other parallels might be:

- The Scarecrow as the American farmer and his troubles in the late 19th century …

- The Tin Man as the industrial worker (or the oil worker — recall the oil can?) …

- The cyclone — which acts as the catalyst for Dorothy’s journey — as a revolution that would transform the drab, gray country (from the impoverished worker’s perspective) into a land of color and prosperity. (This metaphor was in fact used by editorial cartoonists in the 1890s to represent popular upheaval) …

… and so on.

And honestly, those parallels are still valid today. After all, the U.S. Federal Reserve still operates on the same model today as back then.

The Federal Reserve Act of 1913 misled William Jennings Bryan and other naïve congressmen into thinking the Federal Reserve was actually “federal” — part of the government — rather than a group of 12 private banks.

What’s resulted is a system in which the Federal Reserve — the actual all-powerful Wizard of the New Order — creates money out of nothing and loans it to the U.S. government at interest …

… creating the largest man-made bubble in history.

Like in “The Wonderful Wizard of Oz”, we live in a world of illusion, where governments and banksters do all they can to keep the truth from the underlings …

… while their crazy, predatory system ruins the world economy.

Stay tuned, because this yellow-brick road is going to get bumpier!

All the best,

Sean