July 19, 2020 | So Now What?

My buddy Ryan stirred the loins of the rightist barbarians who roam the barren steppes of this blog, bareback, when he dissed the Trudeaus. Papa and junior. Together they’re responsible Ryan pointed out, for half the trillion-dollar debt that Canada will shoulder by the end of the year.

Deficits and debts result from political decisions. Canada now tilts left. The Millennials love it. We have far more government in our lives and, consequently, the bills to show for it. Covid pushed spending into the stratosphere. The question’s simple: what comes next?

Can governments just keep printing and spending money? Is there a reckoning in the distance? Will Trudeau or the next gang to run the place decide austerity and higher taxes are needed to try to balance the books? Or at least stem the gushing river of red?

Well, forget belt-tightening. That ain’t happening coming out of a pandemic, nor does a minority government have any appetite for dishing up cuts. Canadians are addicts. They want more, not less. When small businesses find 62% of workers would rather collect CERB than go back to work, you know what’s coming. All those people have a vote.

CMHC funds research into home equity tax

So let’s assess taxes. If spending won’t drop and cutbacks are off the table, then higher revenues seem a slam dunk. This may be why CMHC, it’s reported, is funding university research into a potential home equity tax. “The objective is to identify solutions that could level the playing field between renters and owners,” says an agency spokesperson.

By sucking about $6 billion a year from the hides of homeowners, this levy would attack what renters and moisters call the ‘financialization’ of real estate. They think property should be for accommodation, and not viewed as an investment asset. Of course allowing people to keep profits on house sales free of tax has created this situation and grossly inflated values. Will the virus end that?

Nah. Not yet. A house tax may well be in our future, but it’s probably not happening any time soon, nor is an increase in the HST likely. The reasons are purely practical. This is a pandemic-induced recession of Biblical proportions. Unemployment is extreme, the GDP has a big hole in it, while airlines and tourism, hotels and concerts plus pro sports and conventions – they’re all on their knees. The engines of economic recovery will (the feds believe) be the same ones that got us out of the 2008 hole. That’s consumer spending and real estate. That helps explain the tens of billions in virus-related and kiddie pogey payments that have been flying around. Plus, of course, 2% mortgages.

Hiking the HST will reduce spending, burdening retailers and delaying recovery. Taxing residential real estate would stop the current boomlet in its tracks. Justin Trudeau – like Stephen Harper before him – is quite happy to let Canadians pickle themselves in unrepayable gobs of mortgage debt because it rekindles economic activity. Cheap rates are a cheap way of making that happen, since we all have no discipline.

So what’s left?

The top three candidate tax increase are…

Here are the main contenders, and what to do about them:

The inclusion rate rises on capital gains rises. This is a really bad idea since it’ll reduce investment when we need it, but politically it’s a winner in a financial illiterate nation. Instead of including 50% of a profit in income, this may become 75%. That’s a mother of tax increase, and should make you seriously considering taking gains soon that you were planning on harvesting in a next few years.

Corporate taxes will pop – from hitting the online giants to your family doc. Ottawa wants a big piece of the profits outfits like Amazon take in, and will move to get it. Also expect the war on personal service corporations to resume as passive income is targeted and doctors are given more reasons to leave. But, hey, who needs ‘em? When the next pandemic comes we can just use vets and podiatrists. Ideas: do not chuck millions into PC for retirement, or you will end up unhappy. Move income into your own hands. Take salary and build up RRSP room. Fund a family trust. Think about an estate freeze.

Expect a new tax bracket for the .01%ers. In his first budget Trudeau whacked people making over $230,000 with a new bracket and a higher overall tax take. There’s another one coming, which will make the deplorables happy but be a further incentive for top execs to find a more hospitable country. If you can, divert compensation into a registered pension plan, ensure you;re income-splitting with a less-taxed partner or kids through a spousal RRSP or loan, and get a seriously hardass accountant.

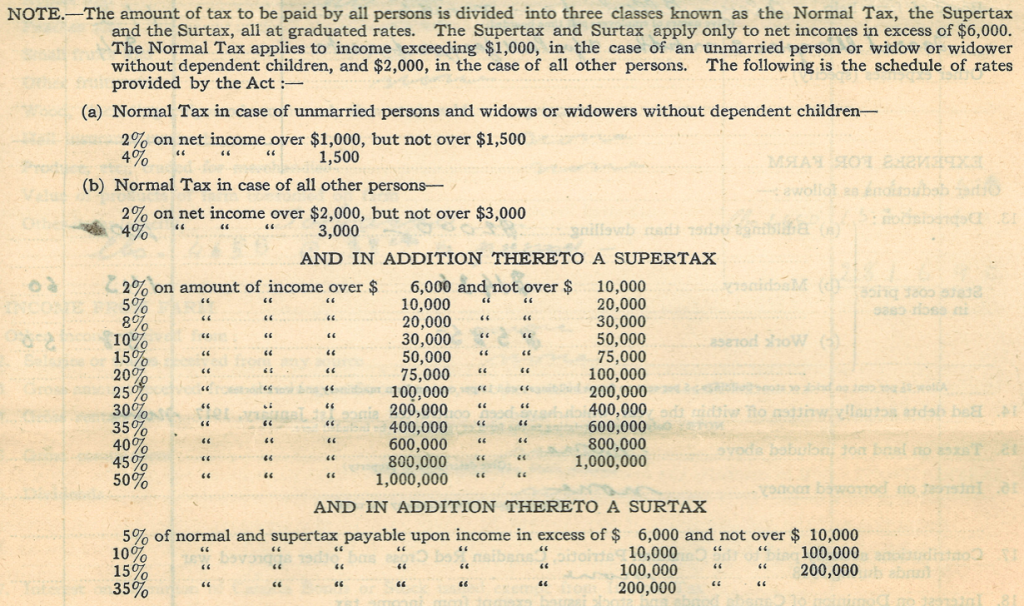

Finally, it’s worth remembering that income tax first arrived in Canada during the pandemic of 1918. It was introduced as a temporary measure to finance WW1 and, of course, became permanent. Blog dog Don was sorting through family papers and came across his grandfather’s ’18 return. “I think it was the first year you had to make a return,” he says. “I’ve attached a copy of the tax categories which I thought you’d find interesting.”

His gross income on a 77 acre farm near Chatham, Ontario was $2916.90. Just over half that income was from Tobacco. It appears no income tax was due as he was married and the net income was under $2000.00. He paid property taxes of $66.96 on a $3200.00 assessment, and $2.00 a year to the Collector of Inland Revenue for a license to grow tobacco. I always read your blog, but never the comments.

And here’s the tax hit from 102 years ago, when the average income was south of $3,000. There were no Trudeaus yet.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner July 19th, 2020

Posted In: The Greater Fool