July 16, 2020 | Lawrence Lepard: Saved By The Printing Press — For Now

Lawrence Lepard, Managing Partner with Equity Management Associates, just released a report that lays out the coming debt crisis in all its apocalyptic glory. The excerpt below is just a tiny fraction of the whole report, which should be read in its entirety by anyone who wonders about the fate of todays financial system.

SAVED BY THE PRINTING PRESS

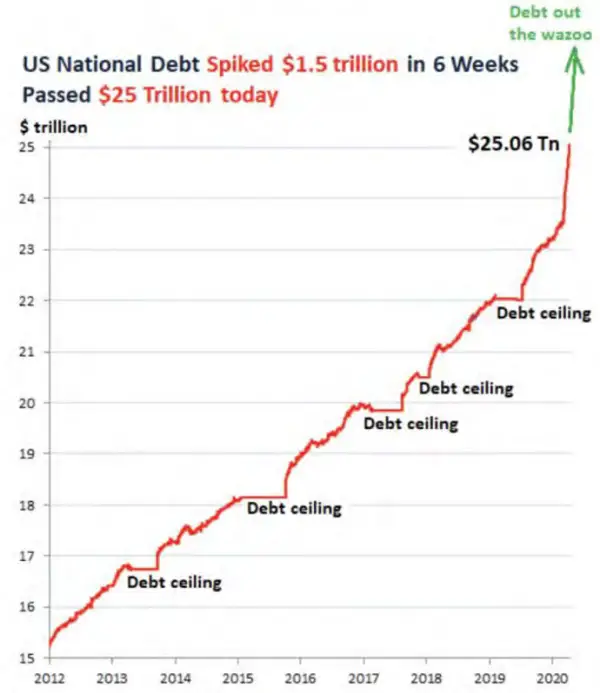

As detailed in our last report, the Government response to the COVID driven bursting of the credit bubble was large and unprecedented. At peak, in the three-month period ended 6/11/2020, the Fed balance sheet expanded by 66% as it grew from $4.2 Trillion to $7.2 Trillion. Most of that growth has been the purchase of US Treasuries as the Fed has had to monetize deficits in the absence of foreign and domestic UST purchasers in this low treasury yield environment.Turning our attention to the US Treasury’s National Debt, the next chart shows just how much that leverage has swelled. Note that this chart is one month old and the US Federal debt today (7/9/2020) stands at $26.5 Trillion.

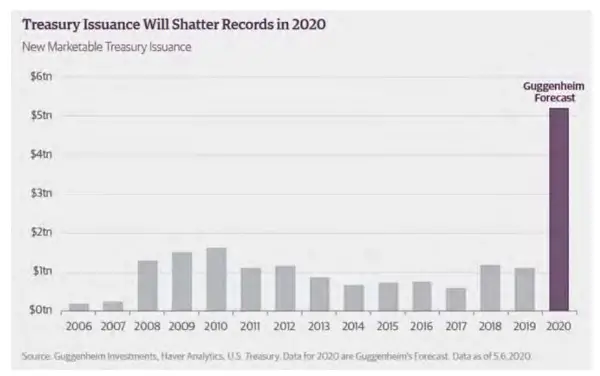

Treasury issuance

The scale of the projected Federal Debt issuance is truly unprecedented when compared to prior years as seen in this chart:

If you find yourself wondering how the government can issue this much debt and still maintain “full faith and credit” in the currency then you are not alone.

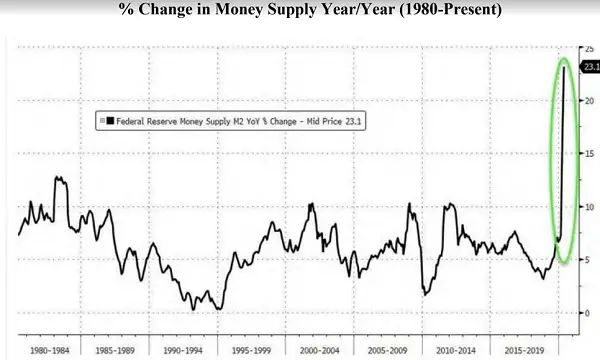

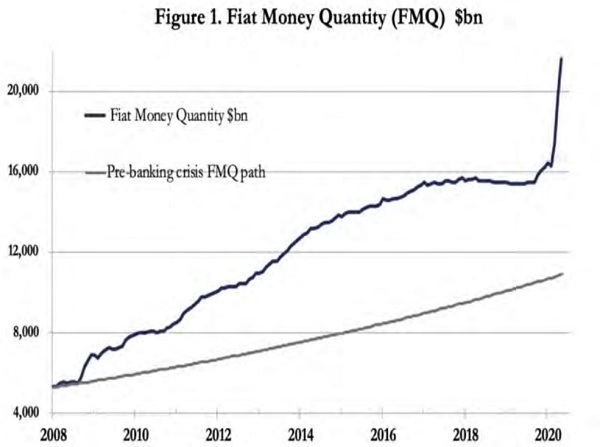

Who is financing these deficits? The Fed. As the chart below shows these actions had a more profound effect on growth of the money supply than those taken after the GFC in 2008. Likely this is due to low interest rates (or concern of growing deficits) no longer enticing domestic and foreign purchasers of US Treasuries as in years past.

The amount of money being created has almost gone vertical.

The report goes on from here to show how soaring debt and parabolic money creation will lead to various kinds of instability, which in turn will send the price of gold through the roof. Read the whole thing here.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 16th, 2020

Posted In: John Rubino Substack