Half of the independent Canadian restaurants recently surveyed say that they are unlikely to survive the current crisis. This is bad news for small business owners in the sector, as well as related lenders, employees, landlords, economic growth and tax collection.

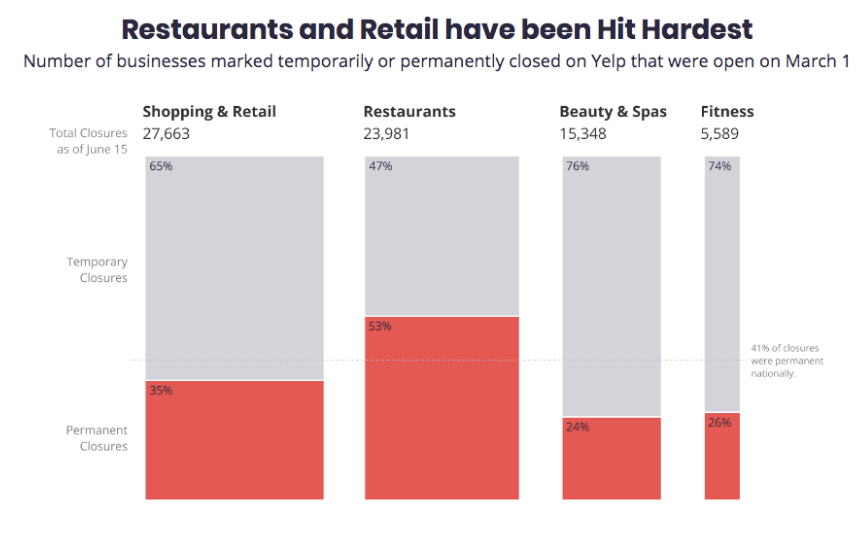

A similar trend is evident in the American data and surveys as shown in the chart below courtesy of Yelp. Forty-one percent of business closures in the household service and retail space since March 1 have been noted as permanent, led by 53% of restaurants.

But there is also a positive side to this story for households. The explosion in eating out and prepared food consumption over the past 15 years helped to drive a pandemic of debt and food-related illness throughout North America. This has come at a heavy cost to family health, self-sufficiency, culture and our tax-funded sick care system. More people preparing their own food at home also means less throwaway packaging and plastic toxins in our environment and bodies. For more on this see: We are all plastic people now, in ways we can’t see – and can no longer ignore.

Recent consumer surveys show that overall Canadians are feeling less stressed about their finances now than at the start of the year. As consumer solvency trustee Scott Terrio explains in the segment below, this is because they are spending less on child care, commuting and eating away from home, but also because they are receiving emergency government subsidies and many debt payments are in deferral. The latter two factors have bought a temporary lull before the default storm that’s building The behavioural change toward spending less and saving more, meanwhile, is likely here to stay. This shift was long overdue and much needed. It is also a negative for economies like Canada and America that are today 60 to 70% reliant on consumer spending.

Scott Terrio, manager of consumer insolvency at Hoyes, Michalos & Associates joins BNN Bloomberg to discuss the MNP Consumer Debt index which highlights the importance of the Canadian government programs for the financially vulnerable and highly indebted. Here is a direct video link.