June 20, 2020 | Trading Desk Notes June 20, 2020

Markets currently seem to be highly correlated into a simple “risk on / risk off” dichotomy…with the emini S+P futures leading the way while other markets follow. If the spuz is bid then WTI catches a bid while the USD and bonds are offered…and vice versa. The tricky thing with trading off inter-market correlations is that the if/then relationship often ends suddenly and the secondary market reverts to trading on its own specific issues.

Inter-market relationships sometimes provide clues as to “why” a market is moving. For instance, when I interviewed Jimmy Rogers many years ago he asked me, “How can you trade wheat in Chicago if you don’t know what’s happening to iron ore in China?”

The CAD has had a strong positive correlation with the S+P this year. I think the rising American stock market the past few months has pulled CAD much higher than Canada specific fundamentals warrant. I’m shorting CAD in part because I think the spuz rally may be overdone but also because if the CAD/spuz correlation weakens and FX traders re-focus on Canada specific issues then those issues will weigh on CAD.

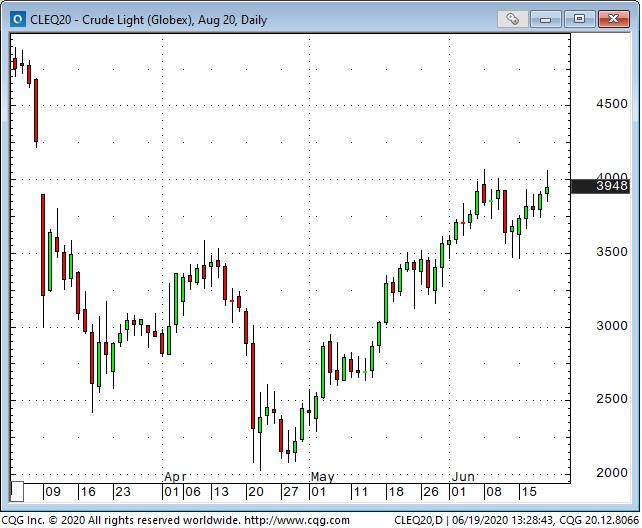

I could make a similar case for shorting WTI.

Gold has chopped back and forth within a $100 trading range for the past 3 months while gold ETF ownership has soared to All Time Highs. Gold has rallied ~$400 in the past year and has certainly benefited from the trend to low/negative real interest rates and the “idea” that massive stimulus will ultimately create inflation.

Final thoughts: I’ve thought that the “risk on” rally from the March lows was a bear market rally driven by irrational exuberance over the massive stimulus, short covering, TINA and FOMO. The rally persisted far longer than I thought…and the higher it went the more aggressively I thought the first break would be bought. Last week I wrote about the “Island Reversals” and how they might signal a top. So far the bounce back from this week’s lows has been strongest in the “big name” stocks while the broader market bounce has been so-so.

One of my favorite chart patterns is the “M” top with a lower second shoulder. The market closing weak today (below the Tuesday – Thursday lows) ahead of the weekend adds to negative market psychology.

My son Drew Zimmerman and I use the futures market to trade currencies, metals, interest rates, stock indices, energy and other commodities. Please give us a call or send us an email if you’d like to know more about trading futures.

Victor Adair

SVP and Derivatives Portfolio Manager

PI Financial Corp

Canada

PI Financial Corp. is a Member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or the authorize someone else to trade for you, you should be aware of the following. If you purchase a commodity option you may sustain a total loss of the premium and of all transaction costs. If you purchase or sell a commodity futures contract or sell a commodity option or engage in off-exchange foreign currency trading you may sustain a total loss of the initial margin funds or security deposit and any additional fund that you deposit with your broker to establish or maintain your position. You may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. If you do not provide the requested funds within the prescribe time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account. Under certain market conditions, you may find it difficult to impossible to liquidate a position. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities and/or futures and options. Any distribution or dissemination of this in any other jurisdiction is strictly prohibited. Past performance is not necessarily indicative of future results

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 20th, 2020

Posted In: Victor Adair Blog

Next: This Week in Money »