June 9, 2020 | Déjà vu: Extremely Valued Tech Companies Propping Up Stock Markets

In the spring of 2000, as now, there was a widespread belief (we remember well, we were there) that the leading tech companies would be impervious to recessionary strife in their customers, the wider economy and financial markets. See The NASDAQ’s summer 2000 bounce, might contain a cautionary lesson:

“Along similar lines, the current environment carries the risk that — with COVID-19 likely to continue disrupting consumer and business activities in the coming months — the financial woes of companies in industries such as travel, energy, auto and hospitality are going to weigh on many of the tech companies directly or indirectly relying on them. And there’s also a real risk that consumer spending in fields such as e-commerce and tech/electronics hardware, which is currently benefiting from stimulus payments and much lower discretionary spending on things such as travel and dining/entertainment, softens in the coming months.”

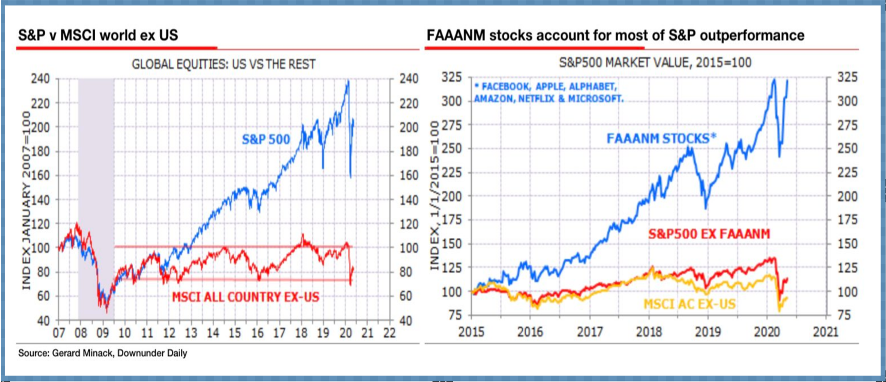

In the recent cycle, we can see (lower left panel in blue) that U.S. stocks traded in lockstep with international markets between 2007 and 2012 before the FAAANM stocks—Facebook, Apple, Alphabet, Amazon, Netflix & Microsoft—exploded away from the rest, taking, not just the NASDAQ, but the S&P 500 index along for a wildly volatile ride since.

In the right panel below, we see the price change (in blue) of these largest six technology companies (FAAANM) from 2015 to now, compared with the flat change in the other 494 companies that make up the index (in red) and negative returns of international markets, excluding the U.S (in yellow).

Tech stocks make up just 8.8% of the Canadian stock market today, but similar price action is evident in the chart below of three largest TSX listed tech companies (Kinaxis-in black, Real Matters-in red and Shopify-in blue) which have rocketed higher following the Feb 20 to March 23 market collapse, while the TSX composite (in green) has languished far behind.

On a valuation basis, as shown below, Canada’s S&P/TSX Info Tech Index is now trading at an average price to earnings multiple of well over 50– about double the five-year average, according to data compiled by Bloomberg. See: Meet the tech companies propping up Canada’s stock market.

Extreme overconfidence in the tech sector was punished severely in past cycles. As shown below, in the spring of 2000 the tech-centric NASDAQ index plunged 41% between March 10 and May 24 before bouncing 41% to make back 60% of its losses by July 14 and treading water there through the summer. Bulls were certain the worst had passed; then, over the next 7 months, the NASDAQ lost another 60% (for a total decline of 78%).

Moreover, it took 15 years, 3 months and 12 days to June 22, 2015, before this basket of stocks recovered its March 10, 2000 high of 5,153. Confirming yet again, that while asset valuations can stay extreme for extended periods of price-indiscriminate speculation and overconfidence, they always exact their capital penalty from holders in the end through sharp drops and years of negative returns thereafter. The price paid always matters eventually.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park June 9th, 2020

Posted In: Juggling Dynamite

Next: Coming up: BC’s Cleanest LNG »