June 5, 2020 | Arousals

Pandemics are temporary. They pass. Demand is delayed, not destroyed. Stay invested.

Yup, that was the message here yesterday. And since March. It was correct. A 40% rise in equity markets was the best 50-day rally on record. Now look at what’s happened.

Markets surged again Friday on the latest jobs news. In the US an astonishing 2.5 million people started working after almost 21 million lost their incomes in April. The unemployment rate fell, when expected to spike. Labour participation swelled. Economists were left with pants around their ankles after forecasting 7.5 million more jobs would be destroyed and the jobless toll would hit 19%. Trump did a jig in the bunker.

And in Canada? Despite the headline shocks from Air Canada and Bombardier, employment is rebounding. Last month 290,000 more people found work when analysts has expected 500,000 would lose their jobs. “Changes in the labour market represented a recovery of 10.6% of the COVID-19-related employment losses and absences recorded in the previous two months,” said StatsCan.

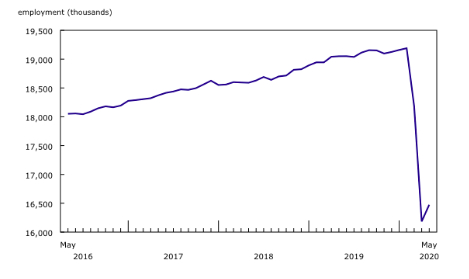

And look at this chart. What an exciting little erection down there.

Employment declines come to a halt in May

Source: Statistics Canada

More good news: three-quarters of all the jobs recovered last month were full-time. Way more people started looking for work, instead of staying home on the CERB, fighting with the cat and snorfling Netflix. Now, combine this with the arousals detailed here yesterday (US airline traffic, oil prices, bank inflows, mortgage apps) and no wonder investors are frisky. Normal may be years away. But the crisis is passing.

Now, let’s talk about social conflict, the wealth divide and growing tensions on a certain pathetic blog. Here’s a comment summarizing the simpering angst and smouldering bitterness of people who are clearly not investors…

The sycophants here spend all their time harping about how the housing market is detached from reality but cheerleading a stock market approaching all time highs with double digit unemployment, large and small businesses failing, airlines not flying, cruise ships docked, movie theatres, restaurants, malls shuttered, etc.

Let’s try being honest now, it’s all pogey, and you guys only have a problem when working people take it.

Let’s try being honest. When you’re rich, white, sitting at the computer clicking stock purchases, scamming the system, and benefitting from governments propping up the stock market — you’re a hero. When you’re a worker who has lost their job and relying on EI — you’re a bum, a loser and a problem. WHY?

It’s true. Wealthy people own. Other people borrow. The virus has rendered the gap worse by exposing the dangers of leverage, real estate lust, over-borrowing and living paycheque-to-paycheque. Those without resources, savings or investments are clobbered when they’re also without income. They’d like everybody to suffer equally. But, tough. Massive government and fiscal stimulus has propped up markets, rescued corporations, dropped financing costs and lubricated credit. Markets love it. Pain’s been transferred from the economy to the taxpayers. So as the pandemic crests then retreats investors come out whole while employees stagger towards the distant light.

Rail against it all you want. But accept it. The banks will continue to thrive and pay dividends to investors, for example, who profit from your mortgage payments. If real estate values fall because CMHC changes the rules and curbs credit as it did yesterday, the lenders (and shareholders) won’t feel a thing. The indebted will. Their equity may fall. Their mortgages will not.

This is a financial blog. (Well, canines, too, with forays into auto mechanics, animal husbandry, sexual tension and epidemiology.) It dispenses advice on how to improve your situation. It’s not here to change the world, bridge the wealth gap, foment social justice, dis white people, decry privilege or elect anybody. That’s what the NDP’s for.

Detailing what financial markets are doing, and why, plus the impact on portfolios is not bragging. Owning ETFs, a bond or some REITs is not scamming the system. Investors risk their capital every day. They lost a ton of it in March. They regained much in April and May. Most of the money’s in retirement savings, pension plans or TFSAs, and the majority of investors have jobs – which is where they got it. Thinking everybody with more than you is just “sitting at the computer clicking stock purchases” is puerile. Grow up.

It’s a shame millions must live off the government’s largesse when they cannot survive eight weeks on their own. That some abuse this is indefensible. That people defer mortgages or refuse rent when they could pay is a mistake. That we’ve built a condo economy so dependent upon selling each other inflated houses with borrowed money is dangerous. That we whine and snipe at the gains of others is diminishing. If we don’t regret such things already, thanks to Covid, that day is coming.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner June 5th, 2020

Posted In: The Greater Fool