May 9, 2020 | Trading Desk Notes May 9, 2020

Stock market indices rallied this week…lead by the Nasdaq index which is now up ~4% YTD after being down ~25% YTD at the March lows…volatility metrics keep falling and the open question is, “How will the “re-opening” play out?”

Stock market investors seem to be anticipating that the “re-opening” will play out just fine. Massive job losses and business shutdowns will be quickly reversed. Virus remedies and vaccines will likely arrive in short order and we will return to normal. US/China tensions have eased after last week’s “punish China” spat…this week’s trade talks have been cordial with both sides planning to implement the Phase One trade deal. The President is focusing on firing up the economy and the Fed is on watch in case anything goes wrong. What’s not to like?

Credit markets seem to be taking a much different view than the stock market…Fed Funds futures actually traded tiny negative this week and the 2Y Treasury yield fell to an All Time low of 0.01%.

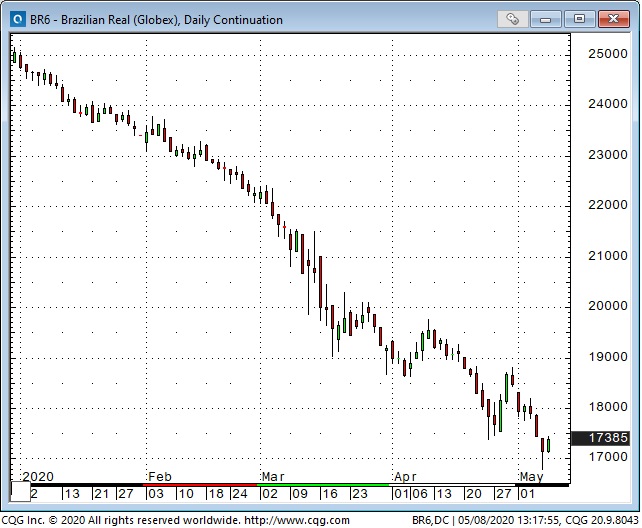

The US Dollar Index soared as stock markets tumbled into the March lows…but then fell sharply when the Fed announced massive stimulus. Since then it’s been a confusing chop fest…although it has continued to be very strong against Emerging Market currencies. The Brazilian Real is down ~30% YTD.

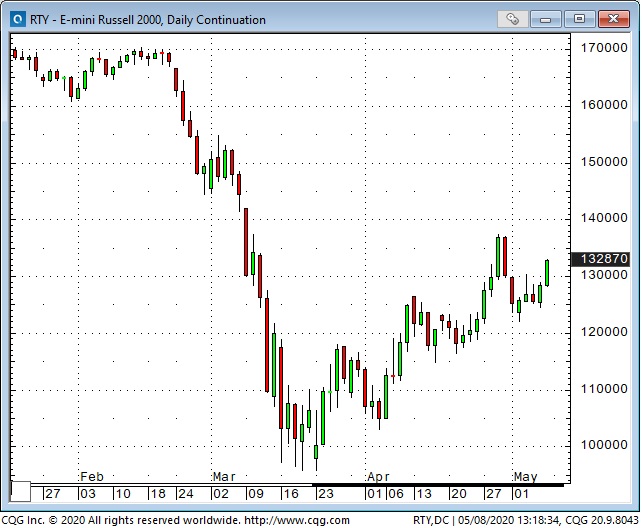

My short term view has been that deflation prevails...that the stock market rally off the March lows has been a bear market rally and I’ve been shorting the Russell 2000 small cap index. Small positions, tight stops, selling on strength, taking profits on breaks. If this market does not take out last week’s highs and falls through this week’s lows I’ll get more aggressive on the short side. It’s possible that the Russell will be bought as a “catch-up” play as it has lagged the other indices. I’m also aware that the consensus view on stocks appears to be bearish so the “pain trade” will see the rally continue.

For more insight on my current thinking please check out the podcast I recorded May 6 and posted to The Trading Desk Notes section of www.PolarFuturesGroup.com I talk about how I decide what to buy and sell, when to take a position and how I manage risks. I discuss specific markets, and note that the CME allowing WTI to trade negative might have been the “Lehman Moment” of the current crisis…as investors suddenly realized that they are exposed to WAY more risk than they had previously thought. I also discuss de-globalization and how that may dramatically increase cooperation between Canada, the United States and Mexico…and how this “virus crisis” may have triggered not only a major transition in markets but also in societies’ relationship with government. If, for instance, people lose confidence in government that would mean much higher interest rates.

My son Drew Zimmerman and I use the futures market to trade currencies, metals, interest rates, stock indices, energy and other commodities. Please give us a call or send us an email if you’d like to know more about trading futures.

Victor Adair

SVP and Derivatives Portfolio Manager

PI Financial Corp

Canada

PI Financial Corp. is a Member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or the authorize someone else to trade for you, you should be aware of the following. If you purchase a commodity option you may sustain a total loss of the premium and of all transaction costs. If you purchase or sell a commodity futures contract or sell a commodity option or engage in off-exchange foreign currency trading you may sustain a total loss of the initial margin funds or security deposit and any additional fund that you deposit with your broker to establish or maintain your position. You may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. If you do not provide the requested funds within the prescribe time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account. Under certain market conditions, you may find it difficult to impossible to liquidate a position. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities and/or futures and options. Any distribution or dissemination of this in any other jurisdiction is strictly prohibited. Past performance is not necessarily indicative of future results

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 9th, 2020

Posted In: Victor Adair Blog

Next: Bill Gates’ Decade of Vaccines »