May 30, 2020 | Trading Desk Notes May 30, 2020

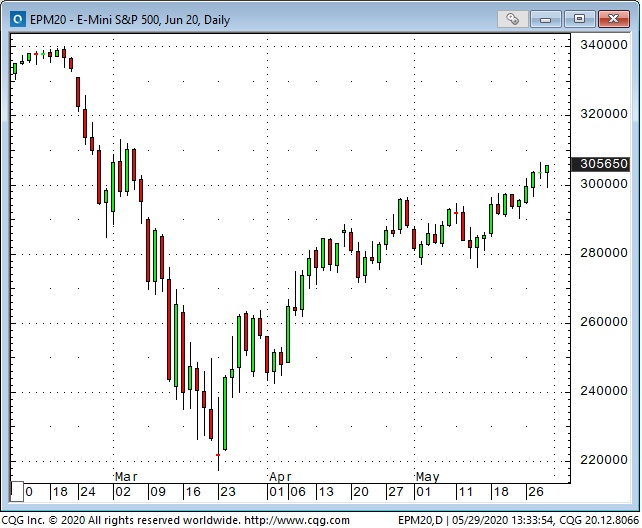

My bias is that the 20% rally in the S+P from October 2019 to February 2020 may have been a “blow-off top” to a 10 year bull market. (I see Tesla running from ~$250 to ~$950 as the poster child for the Irrational Exuberance of that time.) The virus set off a “tumbling dominos” decline from the February All Time Highs to the March lows…massive stimulus in late March sparked a sharp rally that may now be vulnerable to rolling over.

The growing divergence between the “stock market” and the economy the past couple of months may be a warning flag that Mr. Market is too exuberant. The Presidential election is just over 5 months away with polls showing that Biden may be the next President. US/China tensions have been escalating and the first wave of the virus continues to spread around the globe…but the “stock market” continues to be pulled higher by a handful of Big Names…and the late Friday rally after Trump’s “punish China” speech shows that “animal spirits” are alive and well!

You have to wonder who’s been buying. Stock mutual funds have seen net cash outflows. Institutional surveys show that they aren’t buying. Druckenmiller and Buffet aren’t buying. Maybe foreigners are buying (Saudi SWF etc.) as American indices continue to outperform the ROW. Maybe “hedge funds” have been covering shorts. Millions of new retail online accounts seem to be buying with both fists…they will probably buy the first dip…but if the market keeps falling they will likely turn sellers.

My Number One job as a trader is to protect my capital…both financial and mental. My biases may get me into a losing trade but my risk management has to ensure that a small loss doesn’t grow into a big one…that a trade is “only a trade.” My biases may get me into a trade “too early” but my risk management has to ensure that my initial size is small, stops are tight and that I never add to a losing position.

My P+L is down 1 – 2% this month because I traded stock indices and currencies on the expectation that “risk on” would morph into “risk off.” So far that hasn’t happened. My biases probably got me into some trades “in anticipation” of follow through…my risk management kept my losses small when that didn’t happen.

When I wanted to short “the stock market” I used the Russell 2000 index because it has been the overall weakest of the major indices over the past couple of years. I’ve sold it when it seemed over-extended and I’ve sold it when it “broke down.” I seemed to do better selling it when it was over-extended…the “break-downs” seemed to quickly reverse.

The US Dollar index fell to a 2 ½ month low this week...it has generally been weak in a “risk on” environment, strong in a “risk off” environment. Emerging market currencies were especially weak in a “risk off” environment…and have been especially strong in the recent “risk on” environment.

The Chinese RMB fell to a multi-year low this week…credit rising US/China tensions. (This chart shows an increasing amount of RMB are needed to buy USD.)

I’ve been both long and short MEX as a “derivative” of the stock market over the past few months. A couple of weeks ago I bought MEX on the idea that it had been clobbered during the Feb-March decline and looked like it might rally out of a wedge pattern. That worked very well but I exited the trade too early (trading is never a game of perfect!) and compounded my error by actually shorting MEX when the stock market looked like it was rolling over.

I’ve been both a buyer and a seller of CAD over the past couple of months. Lately it seems to trade in sync with the stock market much more than with WTI so if the stock market looks soft I might get short CAD…if the chart looks right. I’m short CAD at the end of this week…although it also rallied a bit following Trump’s Friday afternoon China speech.

My son Drew Zimmerman and I use the futures market to trade currencies, metals, interest rates, stock indices, energy and other commodities. Please give us a call or send us an email if you’d like to know more about trading futures.

Victor Adair

SVP and Derivatives Portfolio Manager

PI Financial Corp

Canada

PI Financial Corp. is a Member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or the authorize someone else to trade for you, you should be aware of the following. If you purchase a commodity option you may sustain a total loss of the premium and of all transaction costs. If you purchase or sell a commodity futures contract or sell a commodity option or engage in off-exchange foreign currency trading you may sustain a total loss of the initial margin funds or security deposit and any additional fund that you deposit with your broker to establish or maintain your position. You may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. If you do not provide the requested funds within the prescribe time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account. Under certain market conditions, you may find it difficult to impossible to liquidate a position. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities and/or futures and options. Any distribution or dissemination of this in any other jurisdiction is strictly prohibited. Past performance is not necessarily indicative of future results

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 30th, 2020

Posted In: Victor Adair Blog

Next: This Week in Money »