May 2, 2020 | Trading Desk Notes May 2, 2020

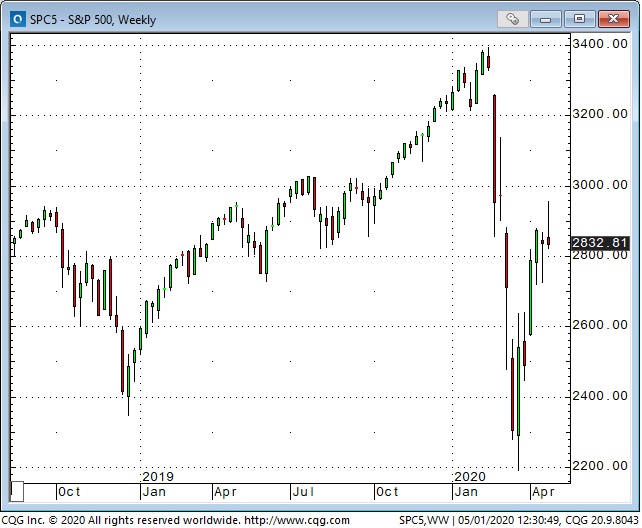

Overextended markets are especially vulnerable to exogenous shocks. The stock market was especially vulnerable to the virus shock in February 2020 after a 45% rally off the Christmas 2018 lows to All Time Highs…with half those gains coming in just the last 5 months as millions of new “commission free” retail accounts piled into the market with abandon. Bob Farrell reminds us that, “The public always buys the most at the top…”

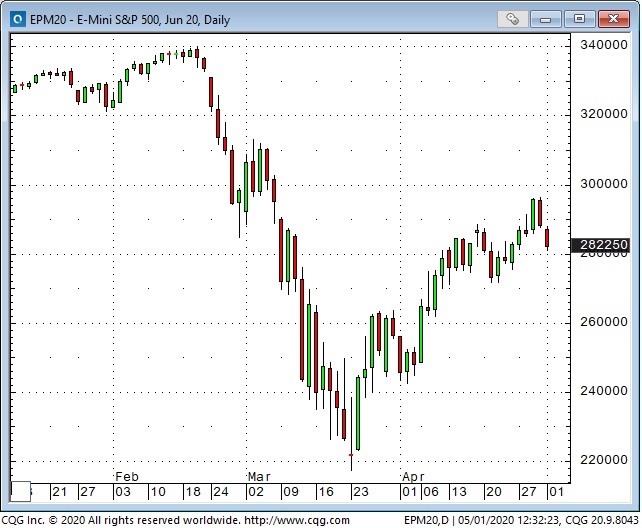

On a shorter time frame the stock market was especially vulnerable to an exogenous shock this week...after a 34% bear market rally in just 6 weeks…the trigger may have been the prospect of a multi-national effort to “punish China”…given what that might produce in terms of geo-political stress and economic fallout. Whatever the trigger was…and there were several prospects including clear indications from Powell that the economy is really struggling…the market did a quick 180 Thursday and Friday.

The Chinese RMB fell close to multi-year lows on the “punish China” story (higher prices means it takes more RMB to buy a USD) as did Emerging Market currencies and the ComDols.

The not-unlikely chances of Tariff Man moving against China in an election year are consistent with my idea of dramatic de-globalization in reaction to the supply chain vulnerabilities exposed by the virus. And while on the topic of tariffs I maintain that there is good reason (votes) to believe that Trump will move to restrict foreign oil from entering the USA…on the grounds that national security requires energy independence…which means protecting/celebrating a vibrant domestic energy industry. Canada and Mexico will not only be exempt from these restrictions but there will be moves to enhance (all kinds of ) cross-border cooperation within North America as de-globalization accelerates.

I’m not trading economic forecasts…I’m trading swings in market psychology. I think that the Fed kept interest rates far too low for far too long after the GFC and this created a psychology whereby…as Gecko put it…folks believed that, “Greed is good,” and they embraced leverage with a passion. Recently the trend has been to de-leverage…voluntarily or otherwise…and I think there is more of that to come…hence my primary view that despite the Authorities’ best efforts we are in a deflationary environment. Inflation might show up later…but in the s/t I think deflation prevails.

Gold rallied >$200 to 8 year highs on the idea that massive stimulus would be inflationary. A very sharp fall in US real interest rates and a softer USD also supported the gold rally. But gold has weakened ~$80 from its recent highs…not much in terms of the wild price swings we’ve seen YTD…but I wonder if gold senses deflation…maybe less buying in India and China…and you know the Millennials aren’t buying gold. I shorted gold at $1735 seeing a “double top” on the chart and sensing vulnerability if it broke decisively below $1700…a break below $1650 would be even more significant.

I certainly “pay attention” to the news...but the more I learn the more I believe that I hardly know anything about what “really” moves markets…so I’ve become very cautious about what I call the “IF/THEN” process of trading. For instance, “IF the Fed prints trillions of dollars THEN there will be inflation,” or, “IF the economy goes into the tank THEN the stock market will fall.” I can’t trade “the economy” but I can trade “the stock market” so if I want to make money trading the stock market I should be looking at the stock market…not predictions about what the economy is going to do.

I can’t imagine trading a market without looking at charts...of that market and charts of things that affect that market. If I had to choose between using charts exclusively or “news” exclusively I’d choose charts…but I don’t have to make that choice…and I don’t want to. My “sweet spot” in trading is when I develop some ideas about market direction that are confirmed by price action. Then the charts become really important for selecting entry points and stop levels.

The “+30% bear market rally” off the Mar 23rd lows was overextended. I shorted the Russell last week but got stopped for a small loss on the Friday rally. Just as well, I thought, if the market wants to close green ahead of the weekend that’s a short term bullish sign.

I re-shorted the Russell Wednesday this week at 1355 on what looked like a blow-off close and will remain short over the weekend. I’m well aware that the stock market could keep rallying even though the economy is in rough shape…in 2009 the market rallied ~60% from the March lows to the end of the year while the economy struggled…so I’m not “convinced” that the market “has to” test the March lows…but if the Russell drops through 1200 or 1150 the sell-off would probably accelerate…and hopefully I would add to my position!

My son Drew Zimmerman and I use the futures market to trade currencies, metals, interest rates, stock indices, energy and other commodities. Please give us a call or send us an email if you’d like to know more about trading futures.

Victor Adair

SVP and Derivatives Portfolio Manager

PI Financial Corp

Canada

PI Financial Corp. is a Member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or the authorize someone else to trade for you, you should be aware of the following. If you purchase a commodity option you may sustain a total loss of the premium and of all transaction costs. If you purchase or sell a commodity futures contract or sell a commodity option or engage in off-exchange foreign currency trading you may sustain a total loss of the initial margin funds or security deposit and any additional fund that you deposit with your broker to establish or maintain your position. You may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. If you do not provide the requested funds within the prescribe time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account. Under certain market conditions, you may find it difficult to impossible to liquidate a position. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities and/or futures and options. Any distribution or dissemination of this in any other jurisdiction is strictly prohibited. Past performance is not necessarily indicative of future results

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 2nd, 2020

Posted In: Victor Adair Blog

Next: This Week in Money »