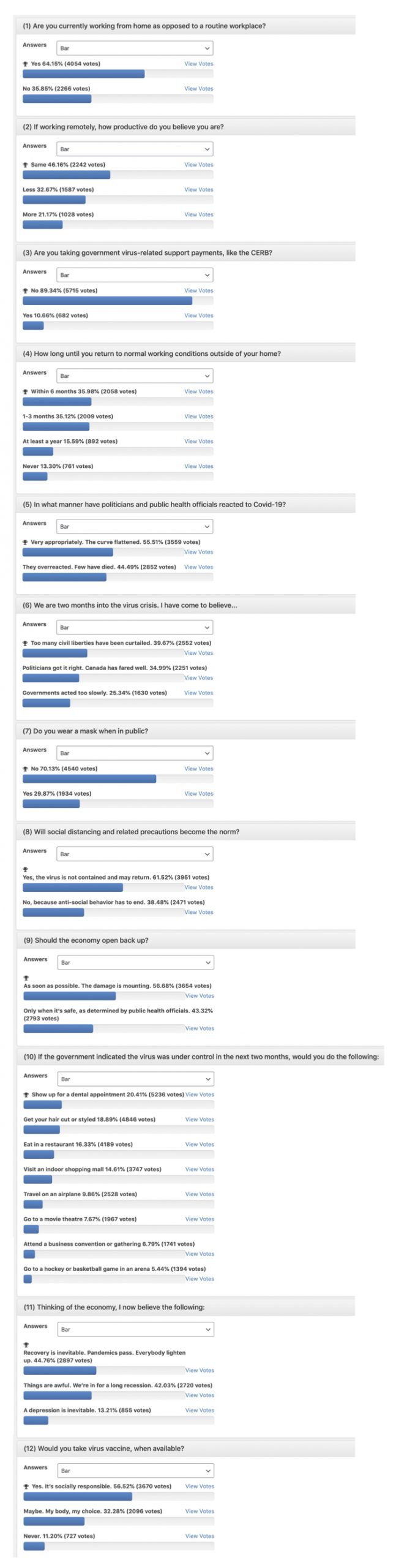

The GreaterFool Nation’s latest poll results are in. A decent sample – over six thousand responses in the last 24 hours. This is interesting: the readership of this pathetic blog appears to drip with maskless cowboys, eschewing government pogey, worried about civil liberties but generally supporting political anti-virus actions and definitely not going shopping or eating out any time soon. Oh, and too damn many anti-vaxxers.

Full results below.

First, did you see the jobless reports? These are weird days when the loss of 1.9 million positions in a single month is considered a big reprieve. That’s what happened in Canada in April, hiking the unemployment rate to 13%. Economists, always a fun bunch, were expecting 18%. Maybe this is why. Here’s what StasCan said: “The unemployment rate in April would be 17.8% if those who had worked recently and wanted a job but did not search for work were included.” So the dollar went up. Stocks, too.

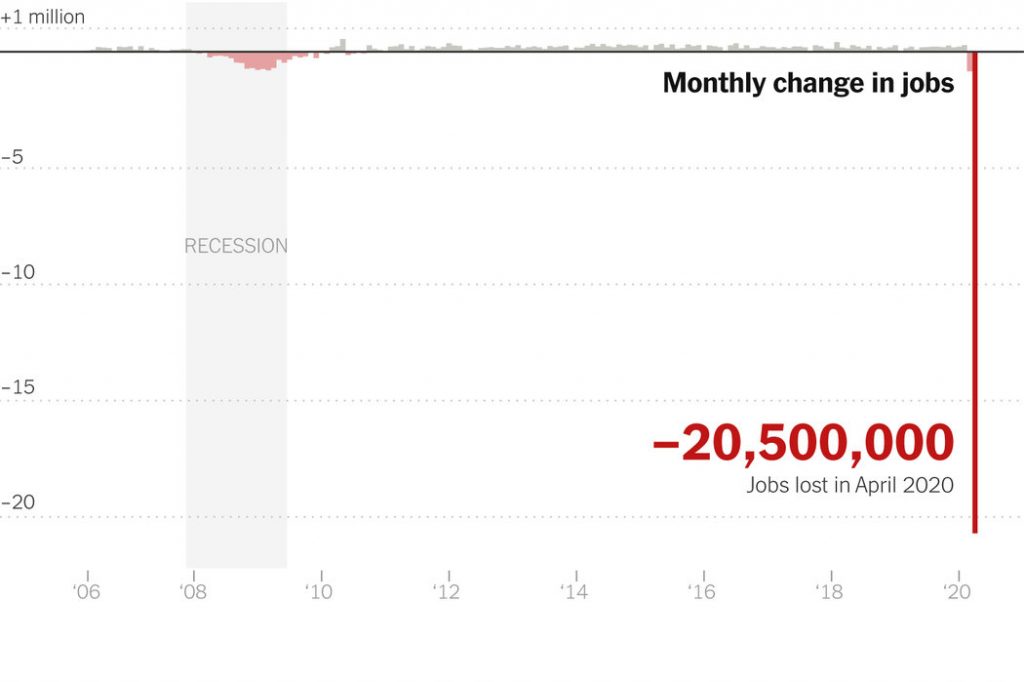

In the States over 20 million jobs evaporated in four weeks, pushing the rate to just under 15%, making Trump the only president since the 1930s to preside over such employment carnage. Actually the rate would have been 20% but millions left the workforce voluntarily. So, in response, the Vix (a gauge of investor fear) went down, bond yields went up and Wall Street advanced. Why? Because the worst news is now known. It gets better from here.

Unprecedented US job carnage. Is this the bottom?

Source: New York Times

The States is in recession. Us, too. But layoffs have levelled out. The number of people seeking a government handout (7.6 million in Canada, 33 million in the States) has trailed off. Economies are starting to trickle open again. Virus cases have peaked in most areas. Mortality rates are tiny in some provinces. The health care sector was not overwhelmed. If you can declare a ‘win’ in a global pandemic, this is one.

So, the gap continues. Financial markets plump as they anticipate recovery and feed off huge CB and government stimulus, but millions of people are unemployed, scores of businesses will fail and the backbone of the Canadian economy – house lust – has been doused. The wealthy hold assets and the rest hold debt. Thus, the chasm between financial investors and the mortgaged grows. As we told you, this will be a lasting legacy of the Year of Covid.

Remember, some 70% of Canadians are into residential real estate, many holding the bulk of their net worth there. So having almost 8 million unemployed or on the dole is a big deal. “How many of these families own homes?” asks mortgage broker Rob McLister. “A meaningful minority. But the bigger question is, how many will continue paying their mortgage after September if/when payment deferrals end? Many believe deferrals will have to be extended. Banks aren’t thrilled by that prospect but most would comply if prodded by the feds. It’s the smaller, less capitalized lenders that simply can’t keep deferring and could be in trouble.”

Recall that Home Capital yesterday increased its loan loss fund by over 650%. Getting ready for what’s coming.

But TD bank thinkers are not so pessimistic – at least for 2021. Sales levels will surge next year, they forecast, but before that, “financial stresses will force some homeowners to list their properties,” resulting in “an outsized decline in home prices in the second quarter.” After that, as economies reopen and jobs return, values start to restore. Now you know when to buy, and sell.

Clearly we’re in the middle of the mess. Not the end of the beginning, but now the beginning of the end. How many people find work again, how long mortgage deferrals or government benefits are in place, what happens to Trump in November, whether we get another virus wave, or a vaccine, or if business failures mount, or malls, rinks, restaurants reopen – all things we do not know.

But as stated here when this began, pandemics pass. They’re temporary, not structural. Recovery comes. How we survive depends on the manner in which politicians, banks, leaders, citizens and, yes, blog dogs respond.

And now to the vox canibus (6,511 unique responses):

(click on image for enlarged view of survey results)