May 19, 2020 | The Bad Omen

Remember when we all knew Americans were hedonistic, debt-lapping, financially crippled, amusing profligates? Well, maybe not. Or could be we’re just way worse.

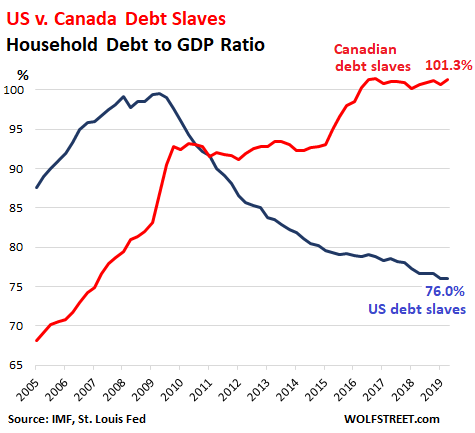

First, consider borrowing. Households in both countries have been intemperate. In fact, when it comes to snorfling loans, Canadians have no equal. US families sharply reduced their appetite for mortgages after the housing market blew up in the mid-2000s, resulting in the credit crisis. But not us. We’ve continued to borrow like there’s no tomorrow (and there may not be), so that total household debt of $2.2 trillion now eclipses the size of the entire domestic economy.

Look at this. Tsk, tsk.

Of course most of this borrowing has gone into mortgages, helping inflate real estate values while deflating savings and investments. Apparently the Bank of Canada and all those one-paycheque-from-disaster surveys were correct. When the virus hit, personal finances disintegrated. The central bank’s latest report finds about a quarter of all families with mortgages were able to make two monthly payments, or less, before exhausting their resources.

Did they buy too much house and take on excess debt? Were lenders remiss and irresponsible in handing out all those loans? Did politicians screw up with all their pro-house-borrowing policies like RRSP loans, newbie tax credits and the shared-equity mortgage? Have we lost the culture of saving and self-reliance? Are these rhetorical questions?

Anyway, here we are. Virus world. Millions temporarily jobless. Mortgages going unpaid. It’s interesting that (at last count) 16% of Canadian owners had asked for payment deferrals, while in the US it’s half the number – 7.9%. Here over 720,000 are deferring and in the States (ten times the pop) the number is four million.

Last week some posters didn’t like the message that asking for a deferral might have consequences. But it’s true. And why not? If you miss payments, it’s noticed. The assumption is you were unable to make them. That doesn’t say anything good about your overall financial condition. If you were a lender, well, you’d make a note of that since staying in business means containing risk and shedding customers who can’t meet their obligations.

As reported. CHMC has been rejecting apps from people looking for refinancing after asking for a deferral. It just makes sense that any household not making payments during Covid will have more hoops to clear post-pandemic when a mortgage comes up for renewal. Is your job secure? What kind of job? How long? What employer? What salary? What’s your net worth? And if you’re self-employed, expect a full body cavity search.

Will a deferral affect your credit score?

Maybe. Deferred payments could end up marked as late or missed on your Equifax tab, which is based on the automated credit reporting system. One black mark like that is enough for a mortgage to be declined, so make sure you check. As a back-up, get a letter from your lender stating deferring payments were approved.

By the way, US virus law prevents lenders from reporting deferred payments to credit bureaus, but only temporarily. “Regardless, the resulting void in your credit history could be a signal to future lenders that you were having trouble,” Americans are being told. “That’s because creditors generally report “on-time” payments as they’re made for credit cards, auto loans, mortgages and so on. Even though your credit scores may not be negatively affected, those missing payments will very likely affect your ability to get a new mortgage in the future.”

So, use common sense. If you don’t need to defer, don’t. The consequences of doing so are unclear. But the statement this sends is not: you can’t pay. Is that really what you want the guys giving you money to think?

Finally remember that deferring a mortgage payment is not the same as having it waived. You still owe the money. It will end up increasing your debt and hiking monthly payment amounts, as well as (maybe) affecting a renewal.

Perhaps this is also a wake-up call. You borrowed too much. Or you saved too little. By the way, if this peckerish virus comes back for a second time, robbing jobs, don’t expect another deferral.

Having said all this, if you can’t make the monthly because you have no money, so be it. The shoe’s on the other foot. Now the bank has a problem.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner May 19th, 2020

Posted In: The Greater Fool