May 21, 2020 | Last Chance?

Would you list your house during a pandemic – when people leap off sidewalks from each other and hide behind masks?

Nah. Most folks are taking a pass. That’s why the number of active listings in all markets has dropped and, in some places, plunged. In the GTA, for example, new offerings in April crashed 64%. Active listings of over 18,000 this time last year have fallen to ten thousand now, down 41%. Lots of those are germy, yucky, have-to-ride-an-elevator condos. The number of detached homes available in traditional demand areas is puny. So anyone brave enough to list is likely to score multiple offers, since it only takes a few dozen people in a city of six million to push values.

This is why sales have tanked in the midst of our worst-ever economic contraction, yet average prices have held steady. The question is, where next? Are buyers who pay pre-virus prices (or more) smart? Or is this a residential death wish?

First, it’s probably a great time to sell your house. Once restrictions start to lift and people feel more confident they’re not going to die after buying veggies at Loblaws, listings will erupt. Yes, many showings will still be via FaceTime or virtual tours, but that’s the new normal.

How do we square this with the dire words (reported here yesterday) coming from CMHC boss Evan Siddall?

Easy. Siddall has his eye on the larger economy, average household finances, employment prospects, debt and a growing aversion to risk on the part of lenders. None of that is good for real estate. So while in some urban hoods demand for decent places on good streets will flourish, the overall picture is dark. Bloomberg’s latest survey of economists, for example, is downright scary – a contraction of 41% taking place in Canada. The last time this happened? Yeah, never.

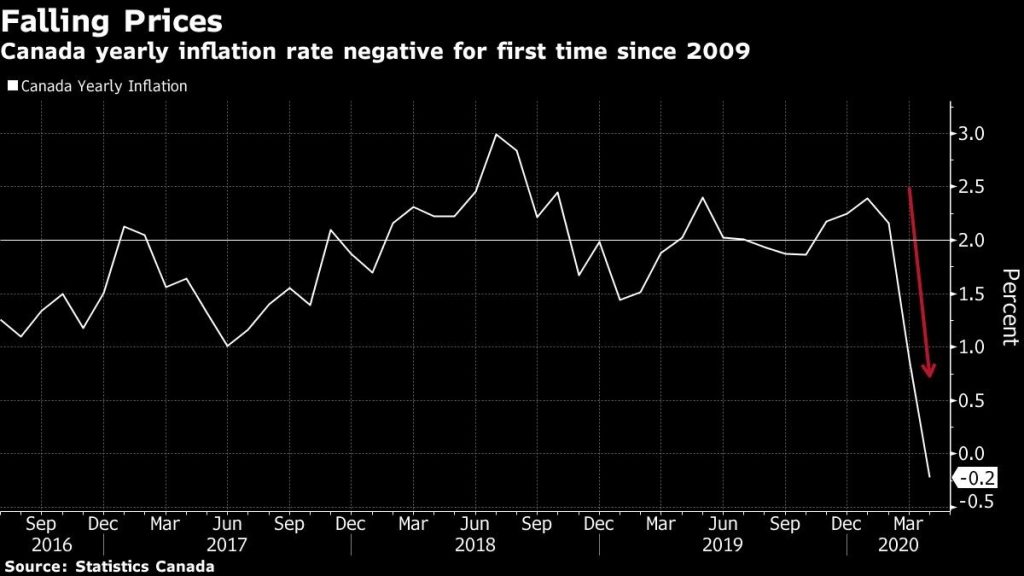

Inflation is negative. Falling gas prices helped drag it down, but weak demand is the real culprit. Millions of people are collecting CERB, at home in their skivvies playing with their kids. They’re not driving, shopping, eating out, getting their hair done or buying sneakers.

Look at interest rates, which are a proxy for economic activity, growth and desire for capital. Mortgages have just fallen below two per cent, with three-year fixed at 1.99% and variables at 1.95% from a variety of lenders. But this is not 2016, and buck-ninety-nine home loan prices won’t inflame a buying wave, not with 14% unemployment and a million families unable to make mortgage payments.

Also, check out small businesses in your neck of the woods. Most are still closed. Many are worried. The CFIB says 55% of the self-employed believe they won’t be able to make June rent, despite the government’s loan and lease-relief schemes. Ottawa is being asked to dump even more free money into this sector. The airlines are a disaster. Most hotels are still shut. Restaurants have no idea how they can survive in an age of social distancing.

RBC says it agrees with Evan Siddall and minimum down payments for houses will have to rise above 5%. “we think there is a reasonable chance that higher minimum down payments may happen, but if it does, the magnitude and timing are unclear, especially since any change might further weaken the economy or at the very least is likely to prolong a recovery in housing market activity…”Capital Economics said Thursday that falling rents – the result of less immigration and job devastation – pose a real threat to real estate values as investors cash out.

Meanwhile the hardest-hit demographic in this Covid world is the young – people sub-30. Unemployment in this cohort is now north of 20%, and traditionally first-time buyers have accounted for about half of all the real estate sales in the nation. Even without a hike in the minimum down payment amount, it’s going to take a while – years – before we see the kids qualifying for mortgages.

These are some of the reasons CMHC says real estate values may drop up to 18% in coming months, while other forecasters warn of a 30% plop. Relatively few Canadians have been killed by this wave of the virus, but we sure offed the economy. Main Street will take a lot longer than Bay Street to get back on its feet, and until then real estate stays confusing. Many people will look at demand overwhelming supply in certain pockets, and be completely fooled.

This is a seller’s market. Briefly. Don’t blow it.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner May 21st, 2020

Posted In: The Greater Fool