July 17, 2023 | Trapped

Happy Monday Morning!

As expected, the Bank of Canada tightened the screws once again, jacking rates up another 25bps, and bringing the overnight rate to 5%, its highest level since 2001.

“It’s working,” Macklem said in an exclusive interview with The Globe and Mail on Wednesday, several hours after raising borrowing costs for the 10th time in a year and a half. “But it’s not working as quickly or as powerfully as we thought it would.”

In other words, despite inflation falling from a peak of 8.1% to 3.4% in May (2.5% when stripping out mortgage interest costs) the job is not done, and the beatings shall continue until morale improves.

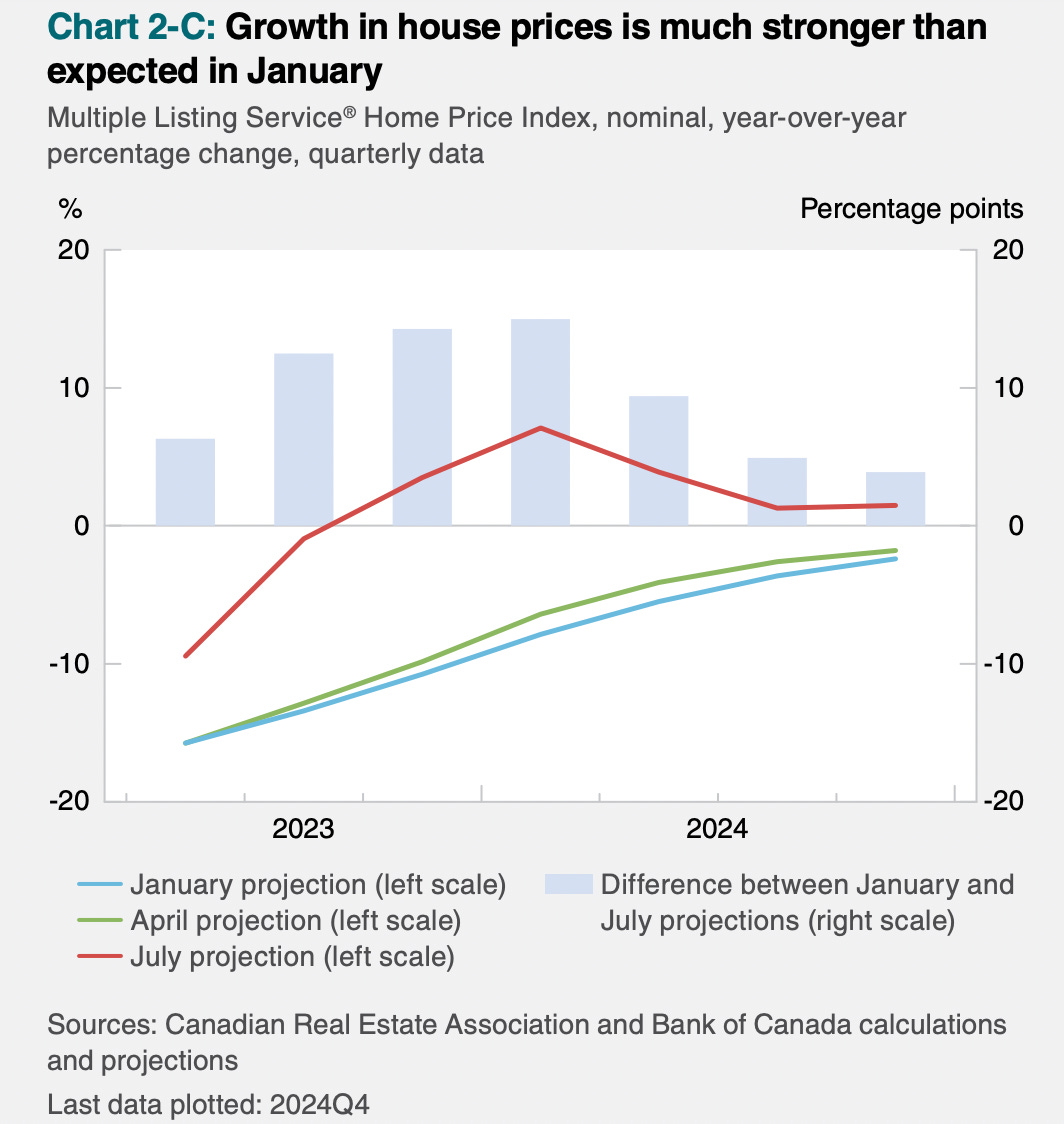

One of the perplexing pain points for the BoC is the resiliency of the housing market. Here’s an excerpt from the latest monetary policy report.

“The faster-than-expected pickup in housing resales, combined with a lack of supply, has pushed house prices higher than anticipated in January. The previously unforeseen strength in house prices is likely to persist and boost inflation by as much as 0.3 percentage points by the end of 2023, compared with the January outlook.”

It’s true the price action in the housing market continues to surprise to the upside. National house prices climbed 2% month over month in June. They’re now up 6% on a seasonally adjusted basis over the past 3 months. No wonder the Bank of Canada is panicking again!

However, let me make one thing very clear. The only reason house prices are going up has been due to a lack of available supply. For most of this year we have been witnessing near 20 year lows in new listings. As of right now, the number of homes available for sale on the MLS system sits at its lowest levels in 20 years (outside of June 2021).

Ironically, all these rate hikes have brought less supply, not more, counter to what most had expected. It’s because people are trapped in their homes! At an 8% mortgage stress test not only do people not qualify to upsize, many don’t even qualify for their current home. Yes it’s true, I am seeing this every day with clients, and colleagues across the industry.

If you want to upsize it typically requires a larger mortgage. Not only do you have to qualify for that mortgage but you have to be willing to stomach a 6% mortgage rate. It’s true you can port your low rate mortgage to a new property and blend it with a new additional mortgage, but that requires you to do so within the lenders 90-120 day timeline. If you sell your home today are you confident you will find another property to close on within that short time period, especially when inventory is hovering near 20 year lows?!

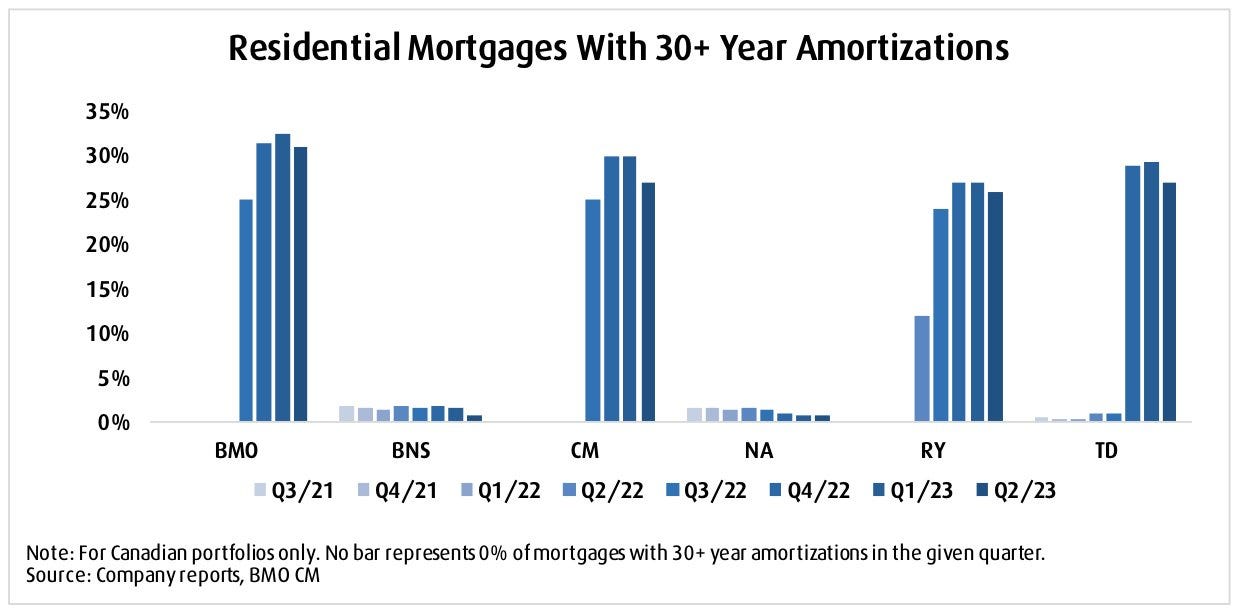

Not only that but think about all those fixed payment variable rate mortgage borrowers. Interest is accruing, amortizations are blowing out, and for the most part banks are leaving their customers alone. Extend and pretend.

But if you decide to move, you better believe the banks are absolutely going to force you to clean up your balance sheet.

Like I said, people are stuck in their homes.

As they say, interest rates are a blunt tool, the effects of which can not always be seen right away. Higher interest rates were certainly needed to cure the disease of Canada’s housing speculation, I fully believe that. But the pace of the move seems to have created unintended consequences.

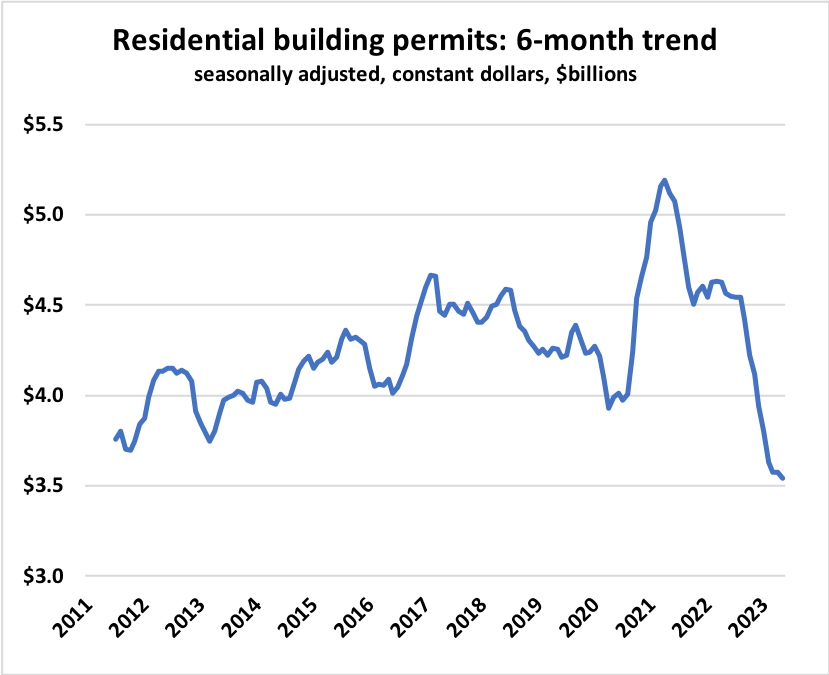

Speaking of which, here’s building permits.

We are sowing the seeds for a future housing crisis 3-4 years from now. Until then, a few levered borrowers will lose their homes and the rest are simply trapped in their current home, unable to move. It turns out there are certain things in life you can’t model in a spreadsheet.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky July 17th, 2023

Posted In: Steve Saretsky Blog

Next: People We Should Know: Ray Dalio »