July 16, 2020 | Huh?

It’s, like, eleven feet wide. Midtown Toronto. No parking. Asked $1.5 million. On the market one day. Multiple offers, sold for $1.8 million. With land transfer tax and closing costs, add another $90,000. So, yes, almost $2 million.

While this transaction was happening, Toronto mega-mayor John Tory was moaning the city faces a $2 billion Covid hit. The subway is 80% less travelled than before. Ten thousand civic workers laid off. Property taxes, he says, may have to rise 60% for the place to survive.

The downtown core is hollowed out. You can rise a bicycle along the Gardiner Expressway without being squashed instantly. GTA unemployment was 5% in December. In May it was 11.5%. Last month that exploded to 13.6%.

Whoa. What’s happening? In June house sales in Toronto rose 83% above those in May (similar story in Montreal – 75% – as well as in Vancouver, London, Ottawa and Fraser Valley). Prices have popped, too. The gain in the GTA was 12% year/year.

But wait. Were in the middle of a pandemic. People living in 416 can’t even get their hair cut. Masks everywhere. Empty streetcars. No schools or child care. Desolate downtown. No immigration. It’s a recession. With an absolutely withering rate of joblessness. How can we have a real estate/housing boom and wall-to-wall, 2016-style FOMO when the economic conditions are such? Are people just crazy? Is this bug now causing mental defects?

Well, this blog told you it was coming. Pent-up demand (as there was no spring market) has slammed right into low inventory (because owners don’t want to list in a pandemic) combined with historic low rates (since the economy is staggering). The result: panic buying. And oh, so much risk.

The federal housing agency, CMHC, is convinced this won’t last. Prices, it says, could fall by 18% over the next year. On a $2 million property, that’s $360,000. Ouch. TD Bank economists are worried, too: “”In our view, as long as unemployment is elevated, population growth slows, and CMHC measures remain in place, growth in home sales and prices is likely to be subdued after this initial burst.” And it’s interesting to hear the view of a career mortgage broker, Rob McLister:

We’re in one of the most punishing recessions ever. Stock prices and home prices are not supposed to approach record highs amid record unemployment, say the textbooks. But while history is a guide, it’s also led many astray. Markets like the GTA are breaking records just two months after the biggest month-over-month selloff ever in April. When markets don’t do what you think they’re going to do, you’re either really early or really wrong. What normally happens with double-digit unemployment… What the CMHC says is going to happen to home prices… What cursory logic dictates should happen in a recession… is not happening. Buyers are realizing they’re not the only ones looking to buy the dip. If prices surge when they’re “not supposed to,” that’s when buyers on the sidelines throw in the towel and pay over asking price for fear of chasing the market higher.

So if you need to buy a house, especially in a desirable real estate market, shut out the noise, take a long-term view and buy quality property that you can afford. Timing the market is risky at the best of times, let alone times of thin supply and unpredictable market psychology.

Good advice. The same’s been said here for a long time. Buy when you need real estate. Purchase what you can afford. Don’t gut your finances or imperil your family in doing so. And today, above all, realize you’re gambling. Realtors will tell you to rush in. Economists are aghast. Both cannot be correct.

So what can go wrong?

Lots, as it turns out.

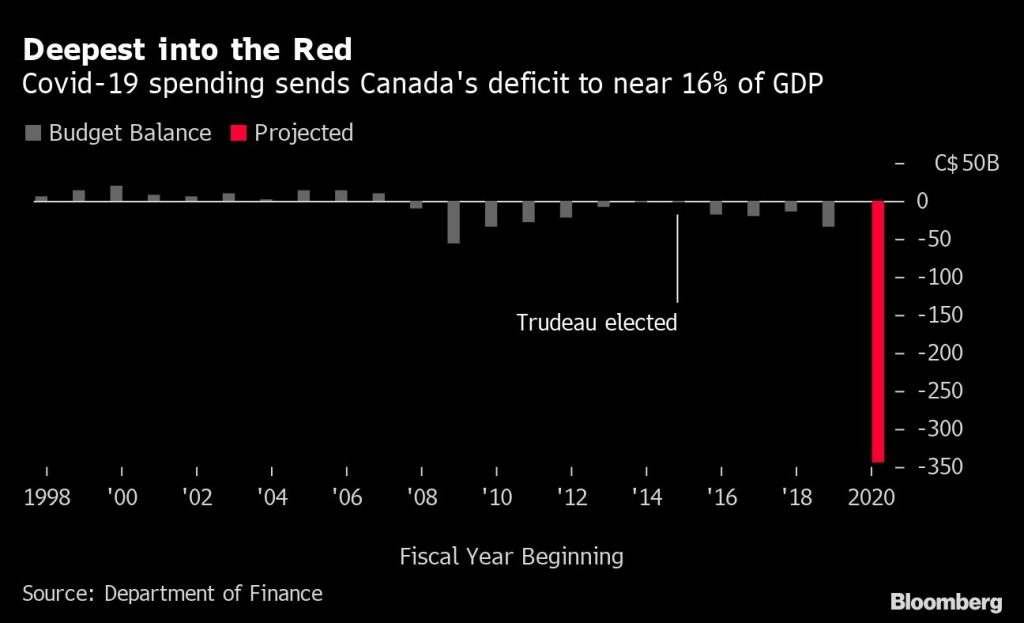

Government largesse, now underpinning the Canadian economy, will end. It has to. Toronto (and other cities) cannot run massive deficits. Hence the mayor’s warning about that incredible tax hike. And sooner or later Ottawa must pay the bills, which could bring higher income taxes or a hike in HST, as well as a reduction in payrolls. Meanwhile, banks – with more than $180 billion in mortgages not currently being serviced – are expected to tighter credit as they seek to rebuild profitability and trim risk. Hospitality, travel and tourism, key drivers of a metropolitan economies, aren’t coming back for years. And immigration has been halted. That could last a long time until Covid’s gone from regions around the world where it now flourishes.

The Bank of Canada says a normal life won’t come back for at least two years. Unemployment of 13% is unlikely to drop again to 5% by that time. Downtown hotels are a 1-5% occupancy levels. Pearson airport traffic has fallen 97%. Millions are still living on the CERB, and that mortgage deferral cliff looms ahead.

Conclusion: same as before. If you need it, can afford it and can swallow the risk, go ahead. Pay too much. Just don’t call this an investment.

Finally, a word from Rod, in Victoria. How much have we distorted the real economy? This much…

Just wanted to add my two cents to the ongoing debate about the effects of the CERB program. I own a painting company in Victoria, BC. At this time of year we would be well into the heart of our schedule with up to 30 employees. Painting is a seasonal trade with more than half the work being completed in the late-Spring and Summer period. One problem in 2020 – no one to hire. After months of advertising in multiple formats, putting the word out, and literally approaching people on the street, we have only hired 2 inexperienced people so far this summer; down from the much needed 15 or so. Quite a dilemma; more work than any time in the past 20 years, but no one to do it. Summer students are non-existent, and most experienced people have disappeared. Where to? A rejuvenated underground economy where $2000 from the Gov’t of Canada acts as the crux to cash jobs. One of our paint suppliers pointed to a major drop in contractor paint purchases and a tremendous increase in homeowner paint purchases. But who’s doing their work? Homeowners generally dont buy 5-gallon buckets of paint. Anecdotally, we hear that many other tradesmen (builders, tilers, carpenters, etc.) are doing the same. What started as our most promising year yet will likely see a 33% drop in income, not because of COVID shutdowns, but because of a dearth of employees. We turn down a dozen jobs per week and are trying to maintain our existing clientele. Did not see this coming or know where it ends up…

Thanks for your advice over the years. It has been indispensable.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner July 16th, 2020

Posted In: The Greater Fool