January 6, 2022 | Elevated Risk Exposure Magnifies Drawdown Impact

Those without the ability or willingness to lose capital and wait years hoping to recover have no business owning stocks and risky debts (including funds and ETFs of them), never mind cryptocurrencies, SPACs, and the myriad of other Ponzi-like instruments. And yet, individuals, asset managers and speculators have never been more fully risk-exposed.

Last month, cash held by portfolio managers was less than 2%, while the percentage of cash in private portfolios touched 10.8%, besting the previous cycle low of 11% cash at the 2007 stock market top (Bank of America data).

As the price of risk has rebounded since March 2020, misplaced confidence among vulnerable, cash-light participants has become deeply entrenched. Record-high property and stock markets have inflated household net worth to a record 790% of the average household’s disposable income—and far beyond the asset bubble peaks of 2000 and 2008 (Rosenberg Research).

American households alone are now holding $43 trillion of equities, nearly twice the size of the nation’s GDP. The stock market represents 40% of their entire balance sheet (which includes real estate equity) compared with 18% as the long-term norm.

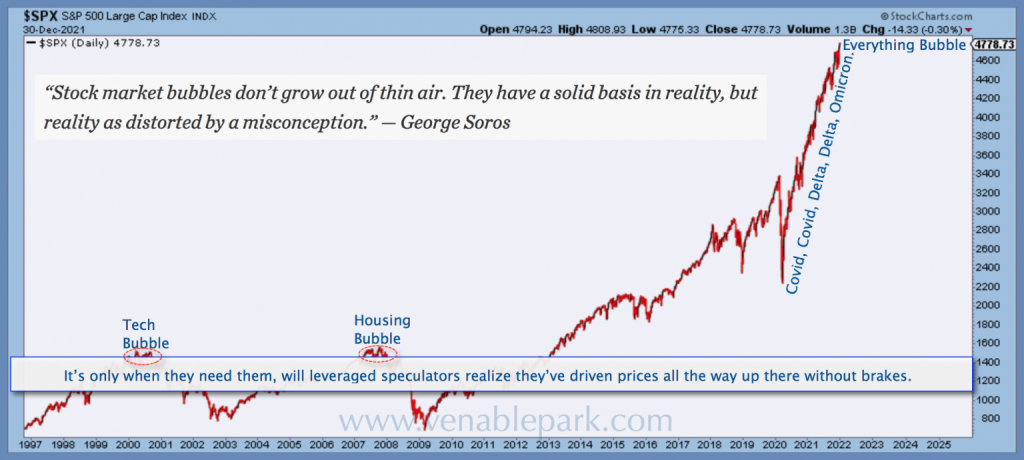

The presently elevated equity exposure (even without leverage) means that just a modest 20% drop in equity markets will hit household balance sheets as hard as a 44% bear market would have in the past. And a 20% market decline would be an extremely modest giveback following the excesses of the past two years. As shown below in my partner Cory Venable’s chart of the S&P 500 since 1997, a 65% decline would be more consistent with mean reversion norms from present extremes.

The good news is that Canada’s TSX has inflated less than the S&P 500 over the past decade, and so its downside from here is perhaps a more muted -50%.

At the same time, household debt and margin debt borrowed against financial portfolios begin 2022 at cycle highs, and leverage further magnifies the impact of drawdowns. Add in the probability of some mean reversion in home prices, and the net effect will be devastating for many. Balance sheet recessions are the worst kind because they hurt not only incomes/revenues but also the savings/equity their owners will need as a backup.

As octogenarian investor Jeremy Grantham has observed from decades of sheepherding billions through complete market cycles: “sooner or later, you will have made money to have sidestepped the bubble phase.”

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park January 6th, 2022

Posted In: Juggling Dynamite

Next: January 6th & Ukraine »