November 1, 2020 | Boom in the Gloom

Let’s connect some dots, as we await tomorrow night’s apocalyptic whatever.

First: interest rates are insane. There’s now a 1.29% variable-rate mortgage available in Ontario. In just a matter of months the inflation rate will be higher. So it’s free money, Bubba.

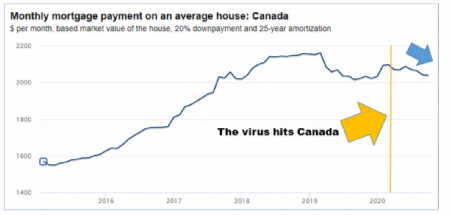

Second: cheap cash greases house prices. People can borrow more on the same income, inflating the cost of real estate, as no other single factor can. Household debt goes up, property values swell while the monthly mortgage burden can actually go down. Look at this RBC chart – home loan financing costs have fallen even as people pay 15-20% more for a house.

Third: the virus has been wicked awful, of course, but perhaps government overreacted. It’s why we now have the biggest federal deficit on the planet and the last finance minister slunk, moaning, back to Toronto.

Check out this conclusion reached by bank economists on Bay Street: Ottawa gave families affected by the virus more than twice the amount of money the bug cost them. “Overall, Canadian households received more money ($56 billion) from government aid programs such as CERB and other transfers in the second quarter than they lost in wages and salaries due to the pandemic ($23 billion).”

Wow. In the middle of a pandemic recession, household income actually rose – by a huge 11% – because of government largess. That made making mortgage payments a whole lot better. It helped create what’s being called a “boom in the gloom.”

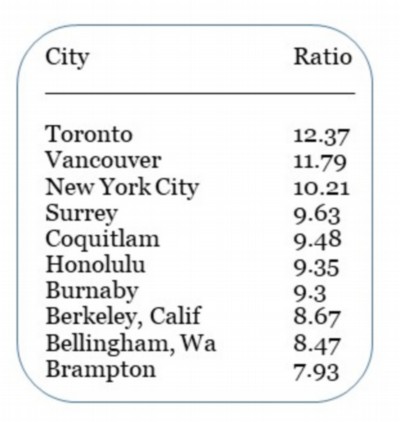

Here’s some evidence you might find interesting. The site Numbeo tracks house prices around the world, measuring affordability against local incomes. Below are the Top 10 cities in North America, ranked by their price-to-income ratios. Not good.

By way of comparison, the price-to-income ratio for Miami is 5.7, while it’s just 3.8 for Chicago and 2.98 for Los Vegas. If you really want a deal, go to Dallas (2.1), Buffalo (1.97) or Detroit (1.26). The point is Canadians are paying some of the highest real estate prices in the world thanks in large part to two things that will not last – excessive government spending and crashed interest rates.

Bond yields started to rise in recent days. Canada’s five-year government bond yield is the stiffest in several months. Ditto with US Treasuries. Our federal government is spending so much money the central bank will have to issue endless bonds to cover it and at the same time buy up existing debt to dampen market forces and keep rates depressed. Since March the Bank of Canada has snapped up 80%, so things are getting extreme. The situation cannot and will not last.

Second, a Biden win on Tuesday (or whenever a winner emerges) will mean less US economic activity as Covid is attacked, and more government spending to compensate. The deficit goes up. More bonds are issued. Higher rates. Our bank follows suit (no choice).

Now, what about more subsidies to Canadian households?

We’ll get the first numbers from Chrystia at the end of this month. Included in the economic statement will be a package of measures made necessary by the second wave of the virus. After that there’s word $20 billion in permanent spending will be added to finance pharmacare and a national child care plan.

But wait. Don’t we have a $340 billion annual shortfall already? Isn’t this, like, seven times the huge hole Harper had to dig to get us out of the 2008 crisis? Aren’t there consequences?

You bet. And connecting to this dot should make it clear excessive, structural spending will inevitably be inflationary so when the virus starts to fade in 2021 interest rates will rise regardless of what the central bank does. Inflation, after all, makes bonds worth less – so the market adjusts prices to reflect that, forcing yields higher.

So, yes, real estate has been on a tear since the virus came. Yup, it’s nuts since we’ve been in a recession and a public health crisis with double-digit unemployment. Almost 13% in Toronto right now. Over 11% in Vancouver. And apparently nobody in Alberta works any more. In fact real estate, like bonds, stocks, fine art and other assets are in bubble territory because of central banks actions in the age of Covid.

None of this is normal. Or permanent. Asset price inflation is dangerous, and once recovery comes The Authorities will bring the hammer down.

This would be a swell time to get out of debt. Unlike everyone else on your street.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner November 1st, 2020

Posted In: The Greater Fool