January 18, 2021 | The Infected

John says he started worrying after his buddy picked up one of those irritating snowmobile-on-water things that had been purchased back in November. At that time the dealership said it had already chewed through a third of its 2021 inventory.

“I’m in the market for a new boat myself,” he tells me, “so after hearing that I went straight to the King Fisher dealership (also Canadian made) and was told that the inventory they had on site was all they were getting for 2021 due to insane demand. That was Jan 10th and they had 10 boats for sale at the time. I called the sales person back on Jan 15th and they were down to four. I was told that if I didn’t buy this week I probably wouldn’t be getting a boat in 2021.

“That was on January 15th, 2021. Keep in mind, these boats cost between $70,000 – $400,000… Either the world has become obsessed with water sports (the outdoor kind) or isolation has driven people nuts. I bought a boat, so it’s possible that I belong in one of those two camps myself…”

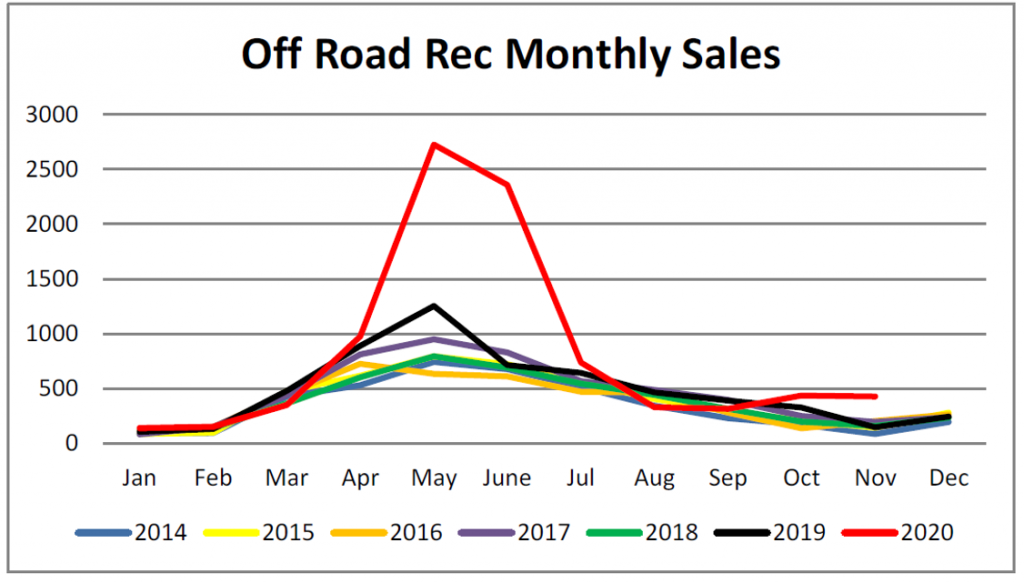

Well, our dude is not alone. RV sales have gone through the roof in the last ten months, keeping pace with the boat guys. And check out what’s been happening with bikers. The Canadian Motorcycle and Moped Industry’s latest report (November) says sales soared 55% year/year, with off-road recreation bikes up a dizzying 194%. And how about quads? Ditto. Sales before Christmas were coursing higher by 48%, and in 2020 an additional 12,000 units had been spoken for.

Meanwhile we know all about real estate. Home sales in December jumped more than 7% from November – which is unprecedented. The number of deals last month was a record across Canada. Compared to the end of 2019, the bump was 47%, pushing prices ahead 13%. For the Year of Satan as a whole, Canadians bought an amazing 550,000 properties.

The places with the biggest price gains? Wow. Small Ontario cities and cottage country. You know – backwater, hayseed, cultural wastelands like Brantford, Barrie, Peterborough, Woodstock, Welland, the Kawarthas and Muskoka – where crazy people buy quads, cruisers and jetskis.

It’s a pandemic spending revolution. No wonder. Airline bookings are down 90% and those people who do flit off to Mexico or Florida are being shamed in an era when ‘non-essential’ travel is a big sin. In parts of the country you can’t even cross a provincial border without being forced into a soul-sucking two-week quarantine. In Ontario it’s impossible to get out of the house for a nice meal or (my fav) to go clubbing and boogie all night to Tiësto or Pascal Letoublon.

So what are we doing instead?

Consuming. Spending. Indulging. Nibbling through that $104 billion pile of chequing-account cash that came from Mr. Socks plus not having to spend money on commuting, childcare, dogwalkers, gas or fresh undies and pants. We’re also borrowing as never before, with household debt levels jumping to a new historic high. No wonder. Five-year mortgages are 1.5% and the longer this damn virus hangs around, the cheaper those loans get.

In a word, change. Societal change. WFH has altered everything for many people. Urban depopulation is a thing. Small town house values have been jacked by Covid refugees. The price of a 2×4 or a sheet of drywall has scaled new heights as home renovations explode. Personal indulgences, as epitomized by $200,000 boats and $15,000 bicycles have turned mainstream. And the slimy little pathogen has done a big number on home affordability, forever locking a generation out of real estate.

Investing? Pfft. This is all about consumption.

And look at this – the latest debt survey from MNP shows just how much Covid has screwed with our heads. Four in ten say they’re not confident they can survive until the vaccine rescues society and their finances without going further into debt. But at the same time, 60% think cheap interest rates make this a great time to borrow more! Especially stuff they couldn’t previously afford! Like an $18,000 quad! Almost half (47%) state these low rates make them feel ‘comfortable’ about carrying an increased borrowing.

But what happens when the cost of money inevitably rises from these all-time lows? Well, according to an RBC survey, it ain’t evah gonna happen. Two-thirds of Canadians have convinced themselves that emergency, once-in-a-lifetime, global-pandemic-induced interest rates are here to stay. The new normal. They say they’re completely ‘unconcerned’ about an increase.

Of course. That makes just as much sense as saying offices will stay shut and you won’t see the boss again. Other than on Zoom. Waist up.

Did you ever think a spike protein could do all this?

So many surprises in store.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner January 18th, 2021

Posted In: The Greater Fool