November 29, 2020 | Debt Porn

Mars and Venus. Do men and women really think so differently when it comes to money and financial security?

Are you kidding? Of course they do. At least according to the leading financial dudettes. Famous women money bloggers like Gail Alphabet, the jar lady, put the repayment, elimination and annihilation of debt at the very tippy-top of their strategy list. Females worry about debt more than males, who spend more time dwelling on facial hair and oil changes.

But while we’re a hideously-indebted and essentially pooched society, there are times when managing debt – not trashing it – can make some sense.

This brings us to an email I received on the weekend:

Drained our two TFSAs, added to savings and paid the $307k remaining in the mortgage. Emotional, not logical. Sweet relief.

Let’s parse this. Does it make sense? Is there enough emotional tingling here to compensate for throwing savings into more real estate equity? What is the actual cost of this mortgage-hating mentality?

Well, five-year, fixed-rate home loans are now available for about 1.7%, so let’s use that number to run some simple calcs. A mortgage of $307,000 would then require monthly payments of $1,255. Over five years they total $75,359, not a small amount of cash flow.

But because rates are so incredibly low, a goodly chunk of every payment erases amortized principal. In this case the repayment portion of sixty monthly cheques adds up to $51,470. Huge. So at the end of five years the debt would be reduced to $255,529.

Now, what if the $307,000 this person possesses in liquid wealth were invested, instead of thrown at debt reduction?

If stuck into a balanced & globally diversified portfolio of ETFs for five years there’s a healthy chance the average annual return would be 6%, judging by the last few decades. (Although I’d wager in a post-Covid recovery period the gains would be outsized.) Sheltering half of this inside TFSAs would also make some gains tax-free.

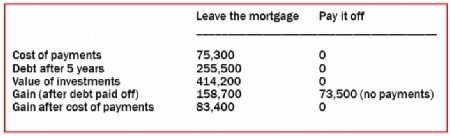

So after sixty months it’s reasonable to believe the $307,000 would have swollen to become $414,200, of which more than $107,000 would be growth. Here’s a summary of what that means:

Paying off the remaining mortgage balance from investment proceeds after five years would leave a balance of $158,700. Yup, have your cake (paid-off house) and eat it too ($158,700 in assets). But the homeowner paid $75,300 in monthlies over that period, so this should be deducted from the balance, leaving a surplus of $83,400. In other words, paying the mortgage off – as Venus so desired – was a costly move when mortgages are so cheap. Eighty grand, or about $1,400 a month for five years.

Lessons?

Inflation is currently 0.7% in Canada, which is crazy low. But it also means a 1.7% mortgage is actually costing just 1%, which is even wilder. We all know that by this time next year, as the vaccine chases the virus, the economy will be recovering, prices and wages rising and inflation plumping. Mortgage money will be essentially free. Milk it. With an amortized mortgage and blended payments, a big piece of debt disappears every month.

Also be wary of concentrating all your net worth in one thing. Even your house. The less diversification in your life, the more risk. Real estate is not immune from big fluctuations caused by property taxes, employment levels, inflation, rates, zoning or a pandemic. Putting all your eggs in one basket is a poor strategy. So stuff your TFSA and keep it that way.

Is it such a bad idea to have some low-cost leverage on residential real estate which has (because of public mania) been rising in value? Of course not. Why hasten to pay it off?

Finally, remember when you get old you can always rent a roof. You can’t rent income. It’s a complete myth that you’ll be secure in a home you own when you lack the cash to heat it or to finance a happy life. Especially if you’re a long-lived woman. Get invested. Stay invested. Be diversified. Be smart about debt. But not obsessed by it.

And stop reading sexist advice.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner November 29th, 2020

Posted In: The Greater Fool

Next: When False Flags Go Virtual »